Understanding Dow Jones Stock Market Futures: A Comprehensive Guide

Dow Jones stock market futures are a crucial tool for investors and traders looking to navigate the complexities of the stock market. These futures provide insight into the potential direction of the stock market before the opening bell, allowing traders to make informed decisions. In this article, we will explore what Dow Jones stock market futures are, how they work, and their significance in the financial world.

As we delve into the intricacies of Dow Jones stock market futures, we will cover various aspects, including their historical context, how they are traded, and the factors that influence their fluctuations. This knowledge is essential for anyone interested in the stock market, whether you are a seasoned investor or a beginner looking to understand the fundamentals.

By the end of this article, you will have a comprehensive understanding of Dow Jones stock market futures, enabling you to make informed investment decisions. Let’s embark on this journey to demystify one of the key components of the financial markets.

Table of Contents

- What are Dow Jones Stock Market Futures?

- The Historical Context of Dow Jones Futures

- How Dow Jones Futures are Traded

- Factors Influencing Dow Jones Futures

- Strategies for Trading Dow Jones Futures

- Benefits of Dow Jones Stock Market Futures

- Risks Involved in Trading Futures

- Conclusion and Future Outlook

What are Dow Jones Stock Market Futures?

Dow Jones stock market futures are financial contracts that allow investors to speculate on the future value of the Dow Jones Industrial Average (DJIA). The DJIA is a stock market index that represents 30 significant publicly traded companies in the United States. Futures contracts are standardized agreements to buy or sell an asset at a predetermined price on a specified future date.

The trading of Dow Jones futures occurs primarily on futures exchanges, where traders can buy or sell contracts based on their expectations of how the DJIA will perform. These contracts are available for different expiration dates, and their prices fluctuate based on market conditions, economic indicators, and investor sentiment.

Understanding Futures Contracts

Futures contracts for the Dow Jones are typically available in two forms:

- Mini Dow Futures: These are smaller contracts that represent a fraction of the full-size futures contract, making them more accessible for individual traders.

- Full-Size Dow Futures: These contracts represent a larger investment and are typically traded by institutional investors or experienced traders.

The Historical Context of Dow Jones Futures

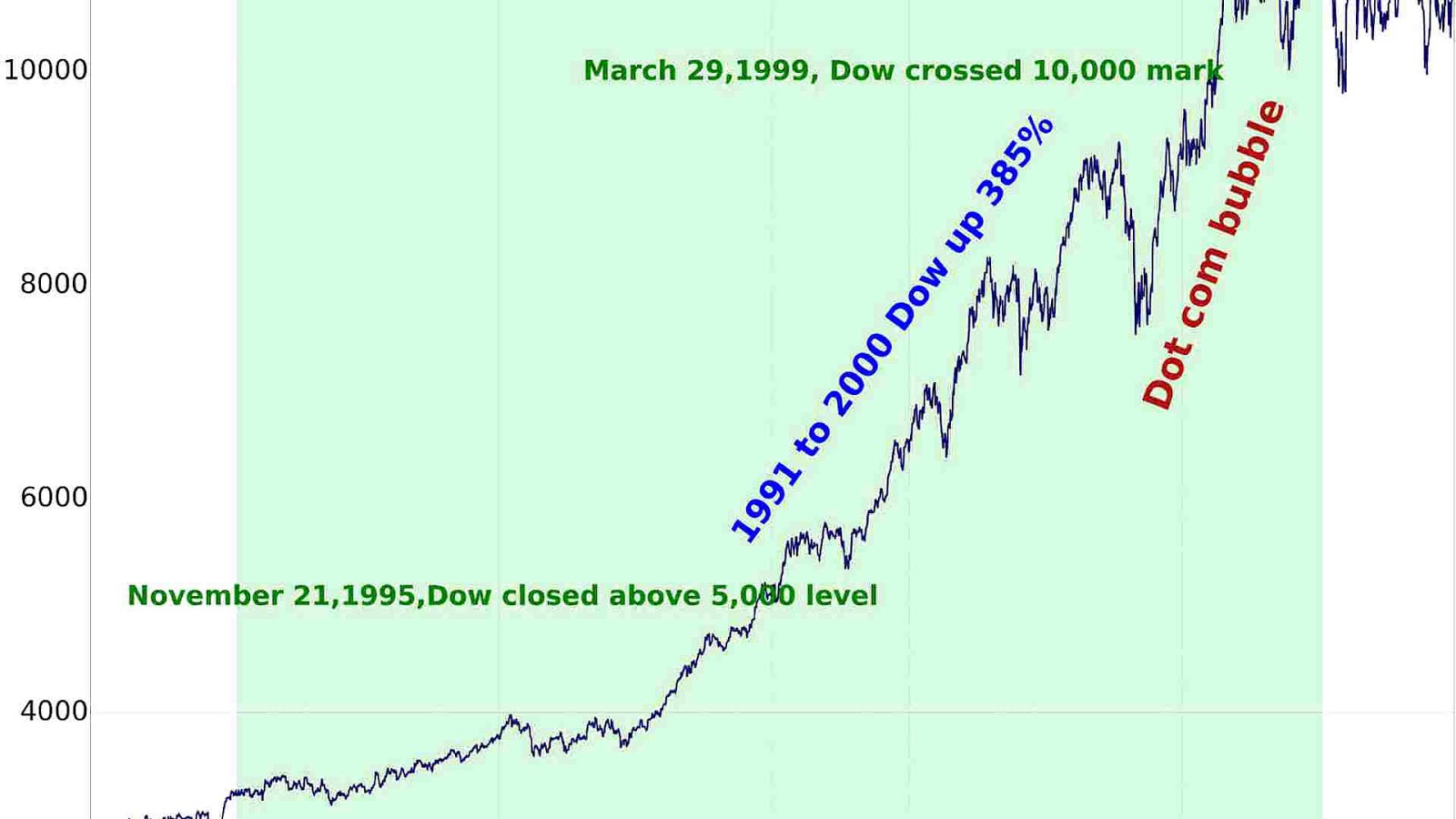

The Dow Jones futures market has evolved significantly since its inception. The concept of futures trading dates back to ancient times, but the modern futures market began in the United States in the mid-1800s. The Chicago Board of Trade (CBOT) was the first to establish a formalized futures market, leading to the creation of various indexes, including the DJIA.

In 1982, the Chicago Mercantile Exchange (CME) introduced Dow Jones futures, allowing traders to hedge against market fluctuations and take advantage of price movements. Since then, the popularity of these futures has grown, making them a vital tool for managing investment risk.

How Dow Jones Futures are Traded

Trading Dow Jones futures involves several steps that traders must follow to participate in the market effectively. Here’s a breakdown of the trading process:

1. Choosing a Brokerage

To trade Dow Jones futures, investors need to open an account with a brokerage that offers futures trading. It’s essential to choose a reputable broker with competitive fees and trading platforms.

2. Fund Your Account

Once the account is set up, traders must fund it with an initial margin, which is a percentage of the total contract value. This margin acts as collateral and allows traders to control larger positions.

3. Placing Trades

Traders can place orders to buy or sell Dow Jones futures contracts through their broker’s trading platform. They can choose between different types of orders, such as market orders, limit orders, and stop-loss orders.

Factors Influencing Dow Jones Futures

Several factors can influence the price of Dow Jones futures, making it essential for traders to stay informed about market conditions. Some of the key factors include:

- Economic Indicators: Reports on employment rates, GDP growth, and inflation can impact investor sentiment and drive futures prices.

- Corporate Earnings: Quarterly earnings reports from the companies within the DJIA can significantly influence futures prices.

- Geopolitical Events: Political instability, trade agreements, and international relations can create uncertainty in the markets, affecting futures pricing.

- Market Trends: Overall trends in the stock market, including bull or bear markets, can also impact Dow Jones futures.

Strategies for Trading Dow Jones Futures

Successful trading of Dow Jones futures requires a well-thought-out strategy. Here are some common strategies that traders utilize:

1. Hedging

Investors can use Dow Jones futures to hedge their existing stock positions, protecting against potential losses by taking an opposing position in the futures market.

2. Speculation

Traders can also engage in speculation by buying or selling futures contracts based on their predictions of market movements. This approach requires a deep understanding of market trends and indicators.

3. Day Trading

Day trading involves executing multiple trades within a single day to capitalize on short-term price movements. This strategy can be risky but potentially profitable for experienced traders.

Benefits of Dow Jones Stock Market Futures

Trading Dow Jones futures offers several advantages for investors:

- Leverage: Futures trading allows investors to control large positions with a relatively small amount of capital.

- Liquidity: The futures market is highly liquid, providing traders with the ability to enter and exit positions quickly.

- Flexibility: Traders can take both long and short positions, allowing them to profit in both rising and falling markets.

- Hedging Opportunities: Futures can be used to hedge against losses in other investments, providing a level of risk management.

Risks Involved in Trading Futures

While trading Dow Jones futures can be profitable, it is not without risks. Traders should be aware of the following:

- Market Volatility: Futures prices can be highly volatile, leading to significant gains or losses.

- Leverage Risks: While leverage can amplify profits, it can also magnify losses, potentially leading to margin calls.

- Complexity: Understanding the intricacies of futures trading requires knowledge and experience.

Conclusion and Future Outlook

In conclusion, Dow Jones stock market futures are a vital component of the financial markets, providing investors with opportunities for profit and risk management. By understanding what Dow Jones futures are, how they are traded, and the factors influencing their prices, traders can make informed decisions that align with their investment goals.

As the stock market continues to evolve, staying updated on economic indicators, market trends, and geopolitical events will be essential for successful futures trading. We encourage you to explore the world of Dow Jones futures further and consider how they might fit into your investment strategy.

If you found this article helpful, please leave a comment below, share it with others, or check out our other articles for more insights into the financial markets.

Thank you for reading, and we look forward to your next visit!

All You Need To Know About IR-R Football: The Ultimate Guide

DHR News: Your Ultimate Source For Daily Updates And Insights

Baltimore Ravens Vs Kansas City Chiefs: An In-Depth Analysis Of Their Rivalry