Understanding Apple Stock Chart: A Comprehensive Guide

Apple stock chart has become a focal point for investors and analysts alike, given the tech giant's significant impact on the market. In this article, we will explore the intricacies of Apple’s stock performance, analyze its historical trends, and discuss what the future may hold for this iconic company. Whether you’re a seasoned investor or just starting, understanding Apple’s stock chart can provide invaluable insights into your investment strategy.

With the rise of technology and digital innovation, Apple Inc. has positioned itself as a leader in the industry. Its stock is not just a reflection of the company’s financial health but also a barometer for the tech sector as a whole. Investors are increasingly interested in understanding the various factors that influence Apple’s stock price. This article will equip you with the knowledge needed to interpret the stock chart effectively.

Through a detailed examination of Apple’s stock chart, we will provide insights into its price movements, trading volume, and key indicators that can help predict future performance. We’ll also delve into the broader market dynamics that affect Apple’s stock, making this article a must-read for anyone interested in stock trading and investment strategies.

Table of Contents

- Apple Stock Chart Overview

- Historical Performance of Apple Stock

- Factors Affecting Apple Stock Price

- Technical Analysis of Apple Stock

- Investing in Apple Stock

- Future Outlook for Apple Stock

- Expert Views and Analyses

- Conclusion

Apple Stock Chart Overview

The Apple stock chart provides a visual representation of the company's stock price over time. This chart is essential for investors as it highlights trends, patterns, and price movements. Understanding the stock chart is crucial for making informed investment decisions.

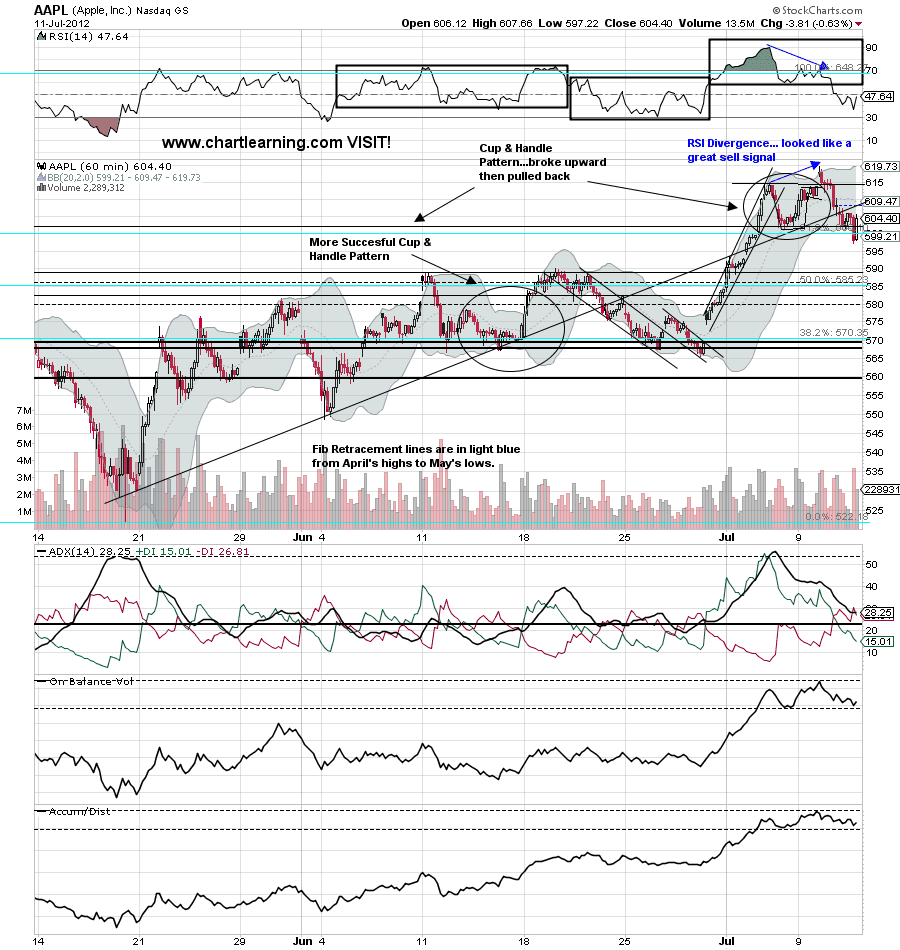

Typically, the stock chart displays daily, weekly, or monthly price movements and includes various indicators such as moving averages and relative strength index (RSI). These tools help investors gauge whether the stock is overbought or oversold, providing insights into potential buying or selling opportunities.

Key components of the Apple stock chart include:

- Price History: Shows past performance and price fluctuations.

- Volume: Indicates the number of shares traded, which can signal trends.

- Moving Averages: Helps smooth out price data to identify trends.

- Support and Resistance Levels: Points where the stock tends to stop falling or rising.

Historical Performance of Apple Stock

Apple's stock has shown remarkable performance over the years. Since its IPO in 1980, the stock has undergone several splits and has grown exponentially. Investors have witnessed various phases of growth, driven by the company's innovation and market expansion.

In the past decade, Apple’s stock has seen significant increases, especially during product launches and major announcements. For instance, the introduction of the iPhone has had a profound impact on the stock price, often resulting in sharp increases following the announcements of new models.

Here is a brief overview of Apple’s historical milestones:

- 1980: IPO price at $22 per share.

- 2007: Launch of the first iPhone, resulting in a surge in stock value.

- 2014: Stock split 7-for-1, making shares more affordable.

- 2020: Stock split 4-for-1, further increasing accessibility for investors.

Factors Affecting Apple Stock Price

Several factors influence Apple’s stock price, including:

1. Earnings Reports

Quarterly earnings reports can cause significant fluctuations in the stock price. Strong earnings often lead to stock price increases, while disappointing results can lead to declines.

2. Product Launches

New product announcements, especially for flagship products like the iPhone or MacBook, tend to have a direct impact on stock performance. Positive reception can boost investor confidence and drive prices higher.

3. Market Trends

The tech industry is rapidly evolving, and shifts in market trends can affect Apple’s stock. Competition from other tech giants and changes in consumer preferences are critical to monitor.

4. Economic Indicators

Broader economic conditions, such as interest rates, inflation, and overall market sentiment, also play a role in Apple’s stock price movements.

Technical Analysis of Apple Stock

Technical analysis involves studying historical price movements and trading volumes to make future predictions. Investors often look for chart patterns that indicate potential price movements.

Some common technical indicators used in analyzing Apple’s stock include:

- Moving Averages: Used to identify trends over specific periods.

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages of a stock’s price.

These tools can help investors make informed decisions about when to buy or sell Apple stock based on historical performance and market conditions.

Investing in Apple Stock

Investing in Apple stock can be a lucrative venture for both short-term traders and long-term investors. Here are a few strategies to consider:

- Diversification: Don’t put all your eggs in one basket. Consider diversifying your portfolio to mitigate risk.

- Long-term Holding: Given Apple’s history of growth, long-term holding can be beneficial.

- Regular Monitoring: Keep an eye on market trends and news that may affect Apple’s stock price.

Before investing, it’s essential to conduct thorough research and consider your financial goals and risk tolerance.

Future Outlook for Apple Stock

The future of Apple’s stock appears promising, but as with any investment, it comes with uncertainties. Analysts often use various models to predict future stock performance based on current data and market trends.

Key areas of focus for future growth may include:

- Expansion into new markets, such as electric vehicles.

- Continued innovation in technology products.

- Growth in subscription services, which provide a steady revenue stream.

Investors should remain informed about Apple’s strategic initiatives and how they may impact stock performance moving forward.

Expert Views and Analyses

Financial analysts and investment experts often provide insights into Apple’s stock performance. Their analyses can be beneficial in understanding market sentiment and expectations for future growth.

Many experts emphasize the importance of keeping abreast of both technological advancements and economic conditions that can influence Apple’s stock price. Regularly reading reports and forecasts from credible financial news sources can help investors stay informed.

Conclusion

In conclusion, understanding the Apple stock chart is crucial for investors looking to make informed decisions. By analyzing historical performance, market factors, and technical indicators, you can gain insights into potential future movements of Apple’s stock. As the company continues to innovate and expand, staying informed will be essential for maximizing investment opportunities.

We encourage you to leave your thoughts in the comments below, share this article with fellow investors, or check out other articles on our site for more insights into the stock market.

Thank you for reading, and we look forward to seeing you again in our future articles!

Stella Banderas: The Rising Star And Daughter Of Hollywood Legends

The Swans Of Capote: An Insight Into Truman Capote's Elite Circle

Discovering Singapore: A Comprehensive Guide To The Lion City