Understanding The Apple Stock Chart: A Comprehensive Guide

The Apple stock chart is a vital resource for investors and analysts looking to understand the performance of one of the most valuable companies in the world. With the consistent growth of Apple Inc. (AAPL) over the years, its stock chart offers insights into market trends, price movements, and investment opportunities. In this article, we will delve deep into the fundamentals of reading and interpreting the Apple stock chart, examining key trends, historical performance, and what the future might hold for this tech giant.

As we navigate through the complexities of the Apple stock chart, we will cover essential aspects including technical analysis, historical data, and the significance of various indicators that investors should consider. Whether you are a seasoned investor or a beginner looking to understand stock market dynamics, this article aims to provide valuable insights.

By the end of this comprehensive guide, you will have a clearer understanding of how to analyze the Apple stock chart effectively, enabling you to make informed investment decisions. Let’s embark on this journey to uncover the intricacies of Apple’s stock performance.

Table of Contents

- 1. Introduction to Apple Stock Chart

- 2. Company Overview

- 3. Historical Performance of Apple Stock

- 4. Understanding Technical Analysis

- 5. Key Indicators to Watch

- 6. Future Outlook for Apple Stock

- 7. Tips for Investing in Apple Stock

- 8. Conclusion

1. Introduction to Apple Stock Chart

The Apple stock chart visually represents the historical price movements of Apple Inc. shares over time. Investors rely on this chart to analyze trends, identify patterns, and make educated predictions about future performance. By understanding the Apple stock chart, you can assess its volatility, market sentiment, and potential investment opportunities.

When examining the Apple stock chart, it is essential to consider various time frames, such as daily, weekly, and monthly charts. Each time frame provides different insights, helping investors tailor their strategies based on their risk tolerance and investment goals.

Moreover, the Apple stock chart is influenced by numerous factors, including market conditions, company earnings reports, product launches, and broader economic indicators. Therefore, staying informed about these elements is crucial for interpreting the chart accurately.

2. Company Overview

Apple Inc. is a multinational technology company headquartered in Cupertino, California. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple is renowned for its innovative products, including the iPhone, iPad, Mac computers, Apple Watch, and services such as iCloud and Apple Music.

| Data | Details |

|---|---|

| Founded | April 1, 1976 |

| Headquarters | Cupertino, California, USA |

| CEO | Tim Cook |

| Market Capitalization | Over $2.5 trillion (as of October 2023) |

Apple is not only a leader in technology but also a significant player in the stock market, attracting investors from around the globe. Its stock (AAPL) is one of the most actively traded and followed stocks due to its consistent performance and market influence.

3. Historical Performance of Apple Stock

To understand the Apple stock chart fully, one must analyze its historical performance. Over the past few decades, Apple has experienced substantial growth, making it one of the most valuable companies globally.

- 2000s: Apple transitioned from a niche computer manufacturer to a dominant player in consumer electronics with the launch of the iPod.

- 2010s: The introduction of the iPhone revolutionized the smartphone industry, leading to exponential growth in stock price.

- 2020s: Apple continues to innovate with new products and services, maintaining its position at the forefront of technology.

Historical price movements can be analyzed through candlestick patterns, moving averages, and volume analysis to identify potential trends and reversal points. Understanding these trends is vital for making informed investment decisions.

4. Understanding Technical Analysis

Technical analysis plays a crucial role in interpreting the Apple stock chart. This approach involves analyzing statistical trends derived from historical prices and trading volumes. Investors use various tools and indicators to assess the stock's performance and predict future movements.

4.1 Candlestick Patterns

Candlestick patterns are essential for understanding market sentiment. Each candlestick represents price movement within a specific time frame, showcasing the open, high, low, and close prices. Common patterns include:

- Doji: Indicates indecision in the market.

- Hammer: Suggests a potential reversal from a downtrend.

- Engulfing: Signifies a strong bullish or bearish movement.

4.2 Moving Averages

Moving averages smooth out price data to identify trends over a specified period. The two most common types are:

- Simple Moving Average (SMA): The average price over a set period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to new information.

5. Key Indicators to Watch

In addition to candlestick patterns and moving averages, several key indicators are crucial for analyzing the Apple stock chart:

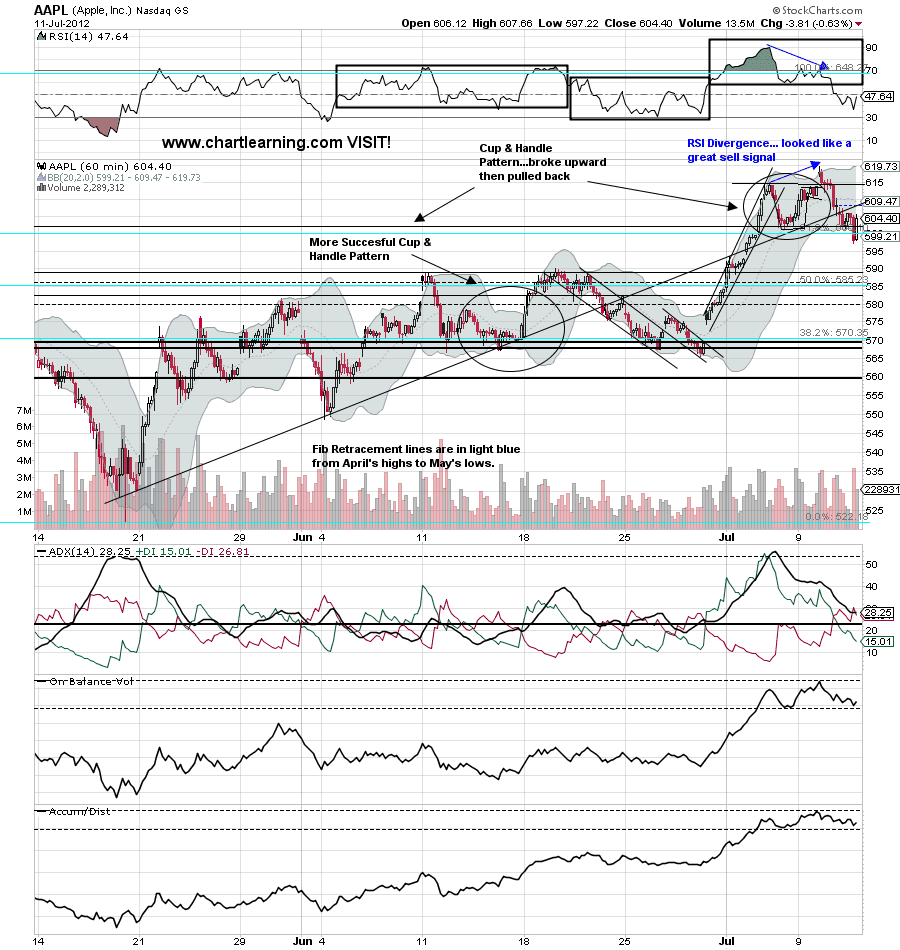

5.1 Relative Strength Index (RSI)

The RSI measures the speed and change of price movements, helping investors identify overbought or oversold conditions. An RSI above 70 indicates overbought, while below 30 signals oversold conditions.

5.2 Moving Average Convergence Divergence (MACD)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It can help identify potential buy and sell signals based on crossovers and divergences.

6. Future Outlook for Apple Stock

The future outlook for Apple stock remains optimistic, supported by the company's strong fundamentals and innovative product pipeline. Analysts predict continued growth in revenue and profits driven by:

- New Product Launches: Apple consistently introduces new products and updates to existing lines, keeping consumer interest high.

- Expansion into Services: The growing services segment, including subscriptions and digital content, provides a stable revenue stream.

- Global Market Penetration: Apple continues to expand its presence in emerging markets, enhancing its customer base.

7. Tips for Investing in Apple Stock

For those looking to invest in Apple stock, consider the following tips:

- Diversify Your Portfolio: Don’t put all your eggs in one basket; diversify to manage risk.

- Stay Informed: Keep up with Apple news, earnings reports, and market trends that may affect stock performance.

- Use Technical Analysis: Leverage technical analysis tools to make informed decisions based on historical data.

- Set Realistic Goals: Define your investment goals and risk tolerance before investing.

8. Conclusion

In conclusion, the Apple stock chart is a powerful tool for investors seeking to understand the performance of this tech giant. By analyzing historical data, employing technical analysis, and monitoring key indicators, investors can make informed decisions regarding their investments in Apple stock. As you navigate the stock market, remember to stay informed and continuously educate yourself about the dynamics of the companies you invest in.

We invite you to share your thoughts in the comments below, subscribe for more insights, or explore other articles on our site to deepen your understanding of investment strategies.

Thank you for reading! We look forward to seeing you again.

Griselda Blanco: The Life And Death Of A Cocaine Queen

Fort Hamer Crossing Parrish Wawa Opening Date: Everything You Need To Know

Exploring Renjun: The Rising Star Of K-Pop