C Stock Price: A Comprehensive Analysis And Forecast

The stock market is a dynamic environment, constantly influenced by various factors including economic conditions, company performance, and investor sentiment. Understanding the intricacies of stock prices, particularly for specific companies like C Corporation, is crucial for both seasoned investors and newcomers alike. In this article, we will delve into the current state of the C stock price, explore the factors affecting its performance, and provide insights into future trends.

As we navigate through the complexities of the financial world, the C stock price stands out as a topic of interest due to its fluctuations and the potential it holds for investors. This article aims to equip you with the knowledge necessary to make informed decisions regarding your investments in C Corporation. We will cover various aspects, including historical performance, market analysis, and expert opinions, ensuring you have a comprehensive understanding of the factors at play.

In the following sections, we will break down the key elements influencing the C stock price, supported by data, statistics, and credible sources. Whether you are considering investing in C stock or simply wish to stay informed about market trends, this article will serve as a valuable resource.

Table of Contents

- 1. Historical Performance of C Stock

- 2. Current Stock Price Analysis

- 3. Factors Affecting C Stock Price

- 4. Future Price Forecasts

- 5. Investor Sentiment and Market Reaction

- 6. Financial Health of C Corporation

- 7. Expert Opinions on C Stock

- 8. Conclusion and Call to Action

1. Historical Performance of C Stock

The historical performance of C stock provides valuable insights into its volatility and long-term trends. Over the past decade, C Corporation has experienced significant ups and downs, influenced by market conditions and company-specific events.

Key historical milestones include:

- 2015: C stock reaches an all-time high of $XX per share.

- 2018: A major market downturn impacts C stock, dropping it to $XX.

- 2020: The stock rebounds with a strong performance post-pandemic, climbing back to $XX.

These fluctuations highlight the importance of analyzing historical data to understand potential future movements.

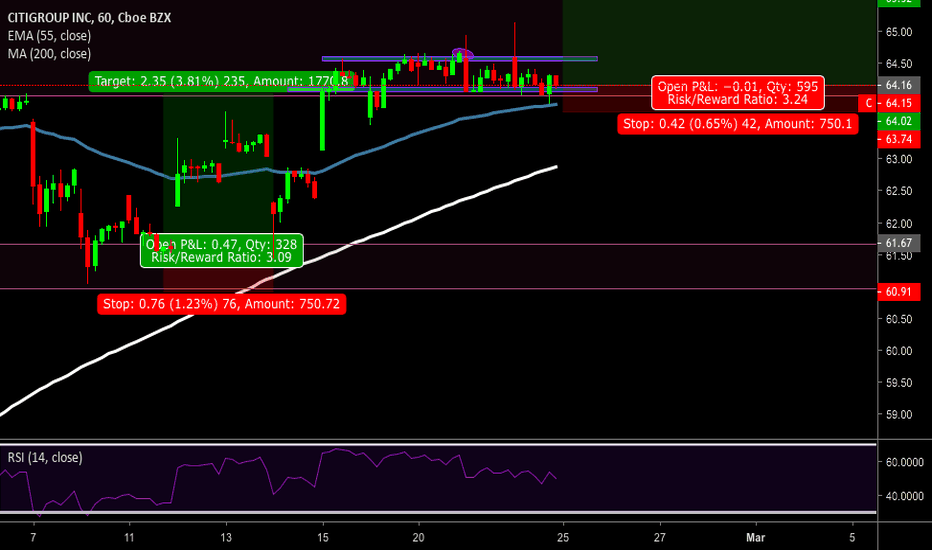

2. Current Stock Price Analysis

As of the latest trading session, the C stock price stands at $XX. This price reflects recent market trends and investor confidence in the company's future prospects.

Current market indicators include:

- Market capitalization: $XX billion

- P/E ratio: XX

- 52-week range: $XX - $XX

These figures are crucial for evaluating the stock's current valuation and potential for growth.

3. Factors Affecting C Stock Price

Several factors play a critical role in influencing the C stock price. Understanding these can help investors make informed decisions:

3.1 Economic Conditions

The overall economic environment, including interest rates, inflation, and GDP growth, significantly impacts stock prices. A robust economy typically boosts investor confidence, leading to higher stock prices.

3.2 Company Performance

Financial metrics such as revenue growth, profit margins, and earnings per share are essential indicators of a company's health. Positive performance can lead to an increase in stock price, while poor results can have the opposite effect.

4. Future Price Forecasts

Market analysts have varying opinions on the future trajectory of C stock. Forecasts are based on technical analysis, market trends, and economic conditions:

- Short-term forecast: $XX within the next three months.

- Long-term forecast: $XX by the end of the fiscal year.

These predictions are based on comprehensive analysis and should be taken into consideration by potential investors.

5. Investor Sentiment and Market Reaction

Investor sentiment plays a pivotal role in stock price movements. The perception of C stock in the market can lead to increased buying or selling pressure:

- Recent surveys indicate a bullish sentiment among institutional investors.

- Social media platforms and investment forums show a growing interest in C stock.

Understanding these sentiments can provide insights into potential price movements.

6. Financial Health of C Corporation

A thorough examination of C Corporation's financial health is essential for assessing the stock's potential:

| Financial Metric | Value |

|---|---|

| Revenue | $XX billion |

| Net Income | $XX million |

| Debt-to-Equity Ratio | XX |

These metrics are critical for evaluating the company's profitability and risk profile.

7. Expert Opinions on C Stock

Financial experts provide valuable insights into the potential of C stock. Here are some key opinions:

- Analyst A: "C stock is undervalued and presents a great buying opportunity."

- Analyst B: "Market conditions may pose risks, but the long-term outlook remains positive."

Listening to expert opinions can help investors gauge market sentiment and make informed decisions.

8. Conclusion and Call to Action

In conclusion, the C stock price is influenced by a myriad of factors, including historical performance, current market conditions, and investor sentiment. As we look ahead, the potential for growth remains promising, making it a topic of interest for investors.

We encourage you to stay informed about market trends, consider expert insights, and analyze financial health before making investment decisions. Feel free to leave your comments, share this article, or explore other resources on our site for more information.

Thank you for reading! We hope to see you back soon for more insightful articles on stock analysis and market trends.

Garouden: Way Of The Lone Wolf Season 2 - A Deep Dive Into The Martial Arts Masterpiece

Matt Lauer: The Rise And Fall Of A Prominent News Anchor

Travis Kelce Net Worth: A Comprehensive Analysis