Understanding Stock Splits In 2024: A Comprehensive Guide

As we approach the year 2024, the financial markets are poised for potential changes, and one of the key concepts investors must grasp is stock splits. A stock split occurs when a company divides its existing shares into multiple new shares to boost the liquidity of trading in its stock. This article will delve into the fundamentals of stock splits, their implications for investors, and what to expect in 2024.

Stock splits can significantly impact both the stock price and investor psychology. As companies opt for stock splits, they often aim to make their shares more affordable, attracting a broader base of retail investors. In this article, we will explore the reasons behind stock splits, historical trends, and the anticipated stock splits for 2024.

By the end of this article, you will have a solid understanding of stock splits, their advantages and disadvantages, and how to strategically approach them as an investor. Let’s dive into the intricate world of stock splits!

Contents

- What is a Stock Split?

- Types of Stock Splits

- Benefits of Stock Splits

- Drawbacks of Stock Splits

- Historical Stock Splits

- Anticipated Stock Splits in 2024

- Strategies for Investors

- Conclusion

What is a Stock Split?

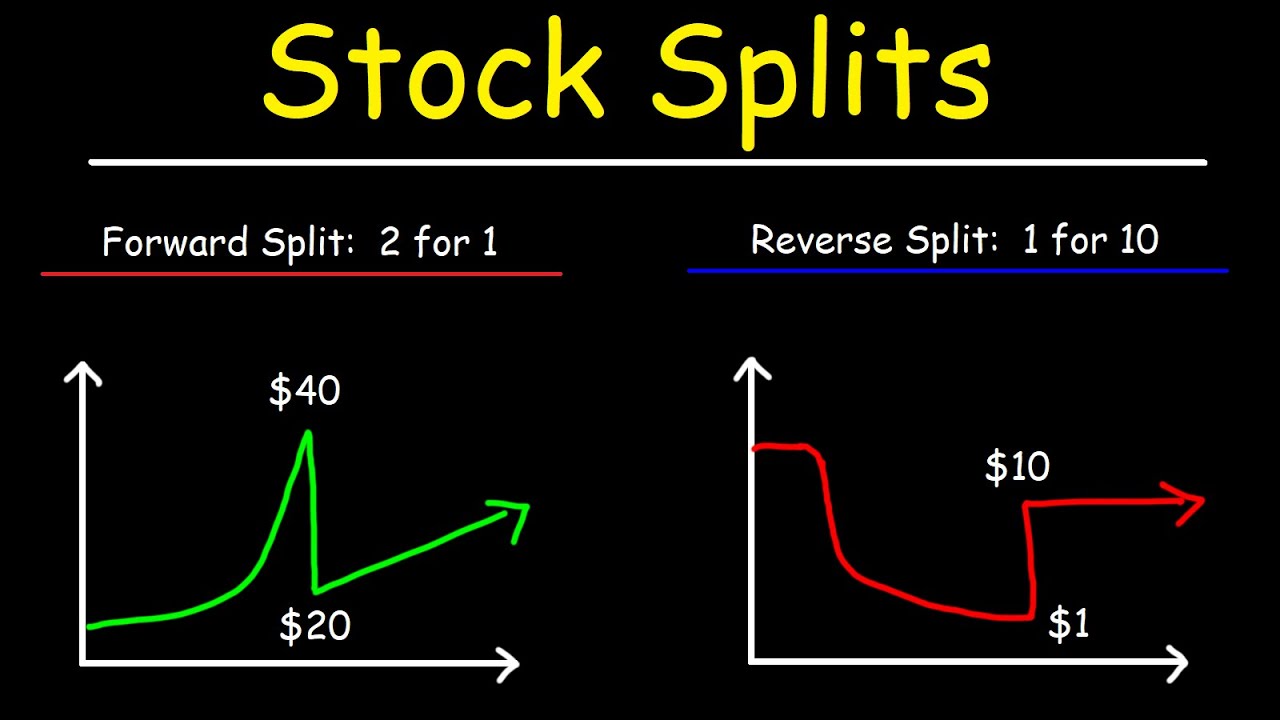

A stock split is a corporate action in which a company divides its existing shares into multiple shares. This action increases the total number of shares outstanding while maintaining the overall market capitalization of the company. For instance, in a 2-for-1 stock split, a shareholder with one share will now hold two shares, each worth half the price of the original share.

How Stock Splits Work

When a company executes a stock split, the price per share decreases, but the total value of an investor’s holdings remains the same. This phenomenon occurs because the company's market capitalization does not change. For example, if a company's stock is trading at $100 per share and it announces a 2-for-1 stock split, the new share price will be $50 per share, but investors will own double the number of shares.

Reasons Companies Split Their Stocks

- To lower the trading price of shares, making them more accessible to retail investors.

- To increase liquidity in the market.

- To signal confidence in the company's future potential.

- To meet listing requirements for stock exchanges.

Types of Stock Splits

There are several types of stock splits that companies may choose to implement, each serving different purposes:

Regular Stock Split

This is the most common type of stock split, where shares are divided into a specified ratio, such as 2-for-1 or 3-for-2.

Reverse Stock Split

A reverse stock split occurs when a company consolidates its shares, effectively increasing the share price. For example, in a 1-for-10 reverse split, shareholders receive one share for every ten shares they previously owned. This is often used by companies to boost their stock price to meet exchange listing requirements.

Benefits of Stock Splits

Stock splits can offer several advantages to both companies and investors:

- Enhanced Liquidity: By lowering the share price, stock splits can attract more investors, increasing trading volume.

- Psychological Appeal: Lower-priced shares may seem more affordable, encouraging more retail investors to buy.

- Market Visibility: Companies may gain more attention from media and analysts, leading to increased interest in their stocks.

- Improved Stock Performance: Historically, stocks that undergo splits have seen positive performance post-split.

Drawbacks of Stock Splits

While stock splits have their benefits, they also come with potential drawbacks:

- No Fundamental Change: A stock split does not affect a company's underlying fundamentals, which may mislead investors into thinking the company is performing better than it actually is.

- Possible Market Volatility: Increased trading volume can lead to short-term price fluctuations.

- Investor Misconceptions: Some investors may mistakenly believe that a lower share price equates to a better investment.

Historical Stock Splits

Looking at historical stock splits can provide insights into market behavior. Notable companies that have executed stock splits include:

- Apple Inc. (AAPL): Apple has performed multiple stock splits, with the most recent being a 4-for-1 split in August 2020.

- Amazon.com Inc. (AMZN): Amazon has never split its stock but has consistently shown strong performance over the years.

- Tesla Inc. (TSLA): Tesla executed a 5-for-1 stock split in August 2020, which was well-received by investors.

Anticipated Stock Splits in 2024

As we look forward to 2024, several companies are rumored to be considering stock splits. Here are some companies to watch:

- Alphabet Inc. (GOOGL): With its high share price, Alphabet has been speculated to consider a stock split.

- NVIDIA Corporation (NVDA): NVIDIA has seen significant growth, leading to discussions about a potential split.

- Netflix Inc. (NFLX): As a high-flying stock, Netflix may also look into splitting its shares to attract more investors.

Strategies for Investors

Investors looking to capitalize on stock splits should consider the following strategies:

- Research the Company: Understand the fundamentals of the company considering a stock split.

- Monitor Market Trends: Keep an eye on historical performance trends post-split.

- Diversify Investments: Don’t put all your money into one stock split; diversification can mitigate risk.

Conclusion

In conclusion, stock splits are a significant aspect of the financial markets that every investor should understand, especially as we move into 2024. They provide opportunities for increased liquidity and psychological appeal to retail investors, but they also come with risks. As an investor, it's essential to do thorough research and consider your investment strategies carefully. If you have any thoughts on stock splits or want to share your experiences, please leave a comment below or share this article with others who may find it helpful!

Thank you for reading, and we hope to see you back soon for more insights into the financial markets!

Fro Stock: Understanding The Dynamics Of Fro Stock Trading

Exploring Jerry Seinfeld's Girlfriend: A Look Into His Love Life

Xela Stock: A Comprehensive Overview Of Investment Opportunities