Understanding NVDA After Hours Price: Trends, Analysis, And Insights

The NVDA after hours price is a crucial aspect for investors and traders looking to capitalize on Nvidia's stock movements beyond regular trading hours. As one of the leading companies in the semiconductor industry, Nvidia has garnered significant attention from investors due to its innovative technologies and robust growth potential. In this article, we will delve into the intricacies of NVDA's after hours trading, exploring how it impacts overall market sentiment and pricing strategies.

In recent years, the after hours trading market has become increasingly popular, allowing traders to react swiftly to news and events that occur outside of standard market hours. Understanding the NVDA after hours price can provide valuable insights into potential price movements and market reactions, especially following earnings reports or major announcements. This guide aims to equip you with essential knowledge and strategies for navigating NVDA's after hours trading effectively.

We will explore various factors influencing NVDA's after hours price, including earnings reports, market sentiment, and economic indicators. Additionally, we will provide expert analysis, compelling data, and actionable insights to help you make informed trading decisions. Whether you are a seasoned investor or new to the stock market, this comprehensive article will serve as a valuable resource for understanding NVDA after hours price dynamics.

Table of Contents

- What is After Hours Trading?

- Overview of Nvidia (NVDA)

- Factors Affecting NVDA After Hours Price

- Historical Price Trends for NVDA After Hours

- How to Trade NVDA After Hours

- Expert Analysis on NVDA After Hours Pricing

- Risks of Trading NVDA After Hours

- Conclusion and Future Outlook

What is After Hours Trading?

After hours trading refers to the buying and selling of stocks outside the regular trading hours of major exchanges such as NASDAQ and NYSE. Regular market hours typically run from 9:30 AM to 4:00 PM EST, while after hours trading usually occurs from 4:00 PM to 8:00 PM EST. This trading period allows investors to react to news and market developments that may occur after the market closes.

While after hours trading provides opportunities for investors, it is essential to note that it also comes with unique challenges. Liquidity tends to be lower during these hours, leading to wider bid-ask spreads and increased volatility. Understanding how to navigate these conditions is crucial for anyone looking to trade NVDA during after hours.

Overview of Nvidia (NVDA)

Nvidia Corporation, founded in 1993, is a multinational technology company known for its graphics processing units (GPUs) and AI computing solutions. The company has become a leader in the gaming, data center, and automotive markets, making it a key player in the tech industry. Its stock, NVDA, has seen significant growth over the years, attracting the attention of both retail and institutional investors.

Personal Data and Company Information

| Data | Description |

|---|---|

| Name | Nvidia Corporation |

| Ticker Symbol | NVDA |

| Founded | 1993 |

| Headquarters | Santa Clara, California, USA |

| CEO | Jensen Huang |

| Market Cap | $X billion (as of October 2023) |

Factors Affecting NVDA After Hours Price

Several factors can influence NVDA's after hours price, including:

- Earnings Reports: Quarterly earnings results can lead to significant price movements. Positive earnings surprises often result in upward price adjustments, while negative surprises can lead to declines.

- Market News: Any major announcements regarding Nvidia, such as product launches or partnerships, can impact stock prices in after hours trading.

- Economic Indicators: Macroeconomic data releases, such as employment figures or inflation rates, can also affect investor sentiment and NVDA's after hours price.

- Global Events: Geopolitical events or significant market movements can lead to increased volatility in after hours trading.

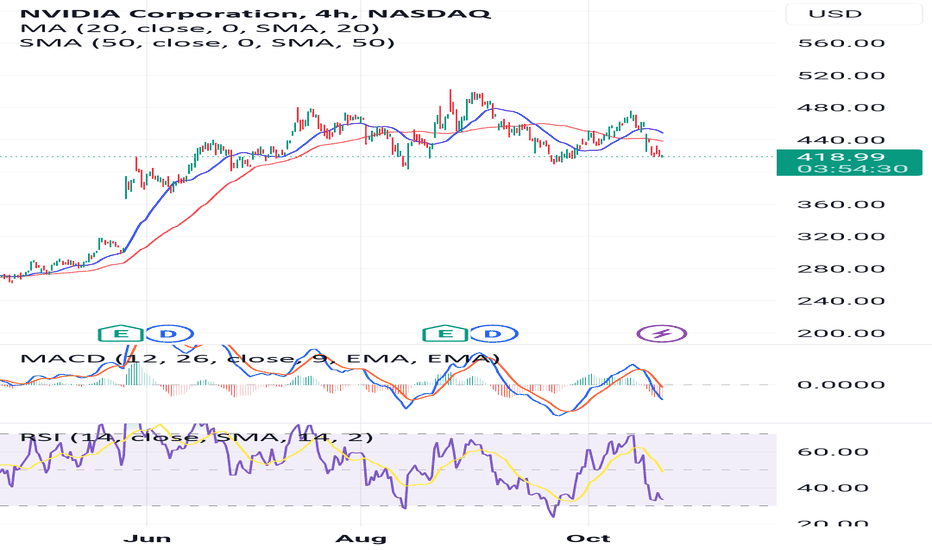

Historical Price Trends for NVDA After Hours

Analyzing historical price trends can provide insights into how NVDA has performed during after hours trading. Over the past few years, NVDA's stock has shown notable volatility in after hours, particularly following earnings announcements. Historical data indicates that NVDA often experiences price surges or declines based on its earnings performance and market sentiment.

For instance, after a strong earnings report in Q2 2023, NVDA's after hours price surged by over 10%, reflecting positive investor sentiment. Conversely, following a disappointing earnings report, the stock experienced a decline of approximately 8% in after hours trading.

How to Trade NVDA After Hours

Trading NVDA after hours requires a strategic approach. Here are some tips for navigating after hours trading effectively:

- Use a Reliable Brokerage: Ensure that your brokerage offers after hours trading and provides access to the necessary tools and resources.

- Stay Informed: Keep up with the latest news and developments related to Nvidia and the semiconductor industry to make informed trading decisions.

- Monitor Volume and Volatility: Pay attention to trading volume and volatility during after hours, as they can significantly impact price movements.

- Set Limit Orders: Consider using limit orders to control the price at which you buy or sell shares during after hours trading.

Expert Analysis on NVDA After Hours Pricing

Market analysts and experts often provide insights into NVDA's after hours pricing trends. According to industry experts, the after hours market can serve as an early indicator of how NVDA will perform in regular trading hours. Analysts recommend closely monitoring trends in after hours trading, as they can provide clues about overall market sentiment and potential price movements.

Additionally, technical analysis tools can be useful for identifying patterns and trends in NVDA's after hours price action. By employing these tools, traders can develop strategies to capitalize on potential price movements effectively.

Risks of Trading NVDA After Hours

While after hours trading can offer opportunities, it also comes with inherent risks:

- Lower Liquidity: After hours trading typically has lower trading volume, which can lead to less favorable prices and increased volatility.

- Wider Bid-Ask Spreads: The difference between the buying and selling price may be wider during after hours, making it more challenging to execute trades at desired prices.

- Limited Information: With fewer participants in the market, information flow may be slower, leading to potential mispricing of stocks.

Conclusion and Future Outlook

In conclusion, understanding NVDA after hours price dynamics is essential for investors and traders. By analyzing factors such as earnings reports, market sentiment, and historical trends, you can make more informed trading decisions. While after hours trading offers unique opportunities, it is crucial to remain aware of the associated risks.

As Nvidia continues to innovate and expand its market presence, monitoring NVDA's after hours price will remain pivotal in assessing its performance. We encourage you to leave your thoughts in the comments below and share this article with fellow traders. For more insights and articles on stock trading, be sure to explore our website further.

Thank you for reading, and we look forward to providing you with more valuable content in the future!

How Does Kakashi Have The Sharingan?

Shenae Grimes: A Comprehensive Look At Her Life And Career

Understanding Ball Stocks: A Comprehensive Guide To Investment Opportunities