Apy Vs Apr: Understanding The Difference In Financial Terms

The terms APY and APR are crucial in understanding financial products and investments. When navigating the world of banking, loans, and investments, knowing the difference between APY (Annual Percentage Yield) and APR (Annual Percentage Rate) can significantly impact your financial decisions. While both terms relate to interest rates, they serve different purposes and are calculated differently. In this comprehensive guide, we will explore the differences between APY and APR, their applications, and why they matter to consumers and investors alike.

Understanding these concepts is essential, especially when you're considering savings accounts, loans, or other financial products. Many individuals get confused between the two, but comprehending their distinctions can lead to better financial planning and potential savings. In this article, we will delve deep into the meanings, calculations, and implications of both APY and APR, backed by expert insights and trustworthy data.

By the end of this article, you will have a clear understanding of APY and APR, empowering you to make informed decisions in your financial endeavors. Let’s dive into the world of interest rates and uncover what sets APY and APR apart.

Table of Contents

- 1. Definition of APY and APR

- 2. How APY and APR are Calculated

- 3. Applications of APY and APR

- 4. Importance of Understanding APY vs APR

- 5. APY vs APR: A Detailed Comparison

- 6. Case Study: Choosing Between APY and APR

- 7. Common Mistakes in Understanding APY and APR

- 8. Conclusion

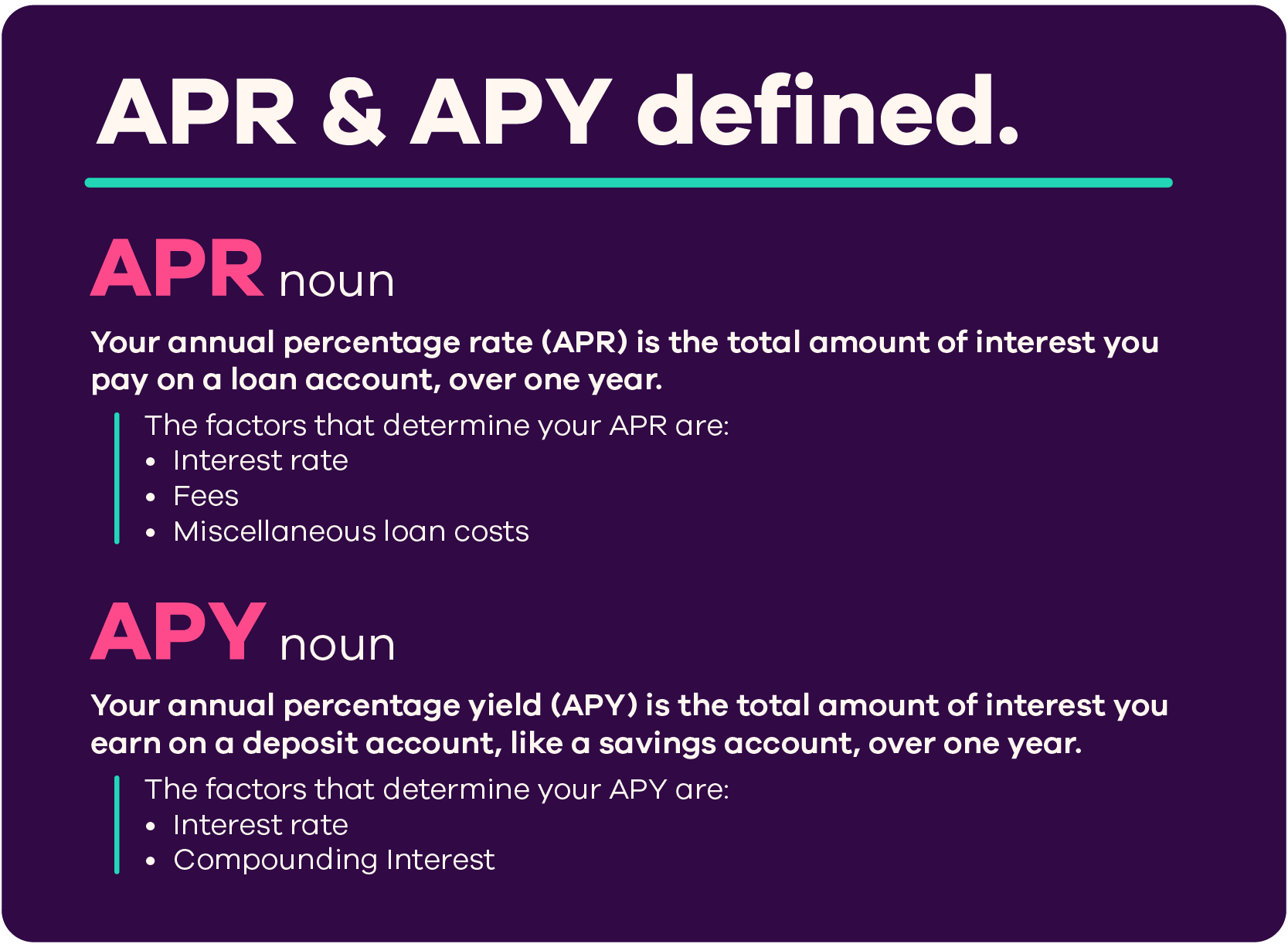

1. Definition of APY and APR

APY, or Annual Percentage Yield, represents the total amount of interest earned on an investment or savings account in one year, taking into account the effects of compounding. It is a useful measure for comparing the potential returns of various savings accounts or investment products.

APR, or Annual Percentage Rate, refers to the annual rate charged for borrowing or earned through an investment without considering the effects of compounding. It is primarily used for loans, credit cards, and mortgages to give a clear picture of what borrowers will pay over a year.

2. How APY and APR are Calculated

The calculations for APY and APR differ significantly due to the inclusion of compounding in APY.

2.1 Calculating APY

The formula for calculating APY is:

APY = (1 + (r/n))^n - 1

Where:

- r = annual interest rate (decimal)

- n = number of compounding periods per year

2.2 Calculating APR

APR is calculated using the following formula:

APR = (Fees + Interest) / Principal

This formula emphasizes the cost of borrowing, making it essential for understanding loans and credit.

3. Applications of APY and APR

APY is commonly used for savings accounts and investment products, helping consumers assess the returns on their deposits. On the other hand, APR is primarily applied to loans, mortgages, and credit cards, allowing borrowers to understand the total cost of borrowing over time.

4. Importance of Understanding APY vs APR

Understanding the difference between APY and APR is vital for making informed financial decisions. Here are some key points to consider:

- Knowing APY helps in choosing the best savings account or investment option.

- Understanding APR is crucial for evaluating loan offers and credit card terms.

- These terms impact your overall financial health and planning.

5. APY vs APR: A Detailed Comparison

Let’s break down the key differences between APY and APR:

- Compounding: APY includes compounding, while APR does not.

- Application: APY is used for savings and investments; APR is used for loans and credit.

- Measurement: APY shows the actual yield on an investment, whereas APR reflects the cost of borrowing.

6. Case Study: Choosing Between APY and APR

Let’s consider a practical example:

Imagine you have $1,000 to invest in a savings account with an APY of 3% versus taking a loan with an APR of 5%.

- If you invest your money at 3% APY, you will earn $30 in interest over the year.

- Conversely, if you take a loan of $1,000 at 5% APR, you will owe $50 in interest over the year.

This case study illustrates how understanding APY and APR can influence your financial decisions.

7. Common Mistakes in Understanding APY and APR

Many consumers make common mistakes regarding APY and APR. Here are a few to avoid:

- Confusing APY with APR when evaluating financial products.

- Ignoring the impact of compounding on investment returns.

- Neglecting to read the fine print regarding fees and terms associated with APR.

8. Conclusion

In conclusion, understanding the differences between APY and APR is essential for anyone looking to navigate the financial landscape effectively. By recognizing how each term applies to savings, investments, and loans, you can make informed decisions that positively impact your financial health.

We encourage you to leave a comment with your thoughts on this topic, share this article with others who might benefit, or explore more articles on our site to further your financial literacy!

Thank you for reading! We look forward to seeing you back for more insightful financial content.

Carmy Berzatto: The Rise Of A Culinary Genius

Jonathan Candy: A Comprehensive Biography And Career Overview

Baxter Stock: An In-Depth Look At The Company’s Performance And Future Prospects

:max_bytes(150000):strip_icc()/Apr-apy-bank-hopes-cant-tell-difference_final-15cefe4dc77a4d81a02be1e2a26a4fac.png)