Mastering Your Finances: A Comprehensive Guide To The Mint Budget App

The Mint Budget App is an essential tool for anyone looking to take control of their finances. With its user-friendly interface and powerful features, Mint helps users track their spending, create budgets, and achieve their financial goals. In today's fast-paced world, managing finances can be overwhelming, but with Mint, you can simplify this process and make informed decisions about your money. This article will explore the features, benefits, and tips for effectively using the Mint Budget App, ensuring you get the most out of this financial management tool.

Whether you're a college student trying to manage your limited budget or a professional aiming to save for a major purchase, the Mint Budget App offers tailored solutions for everyone. By providing insights into your spending habits and helping you set realistic financial goals, Mint empowers users to build better financial habits. In the following sections, we will delve into how to get started with the app, its various features, and best practices to maximize its potential.

As we navigate through the digital age, having a reliable budgeting tool is more critical than ever. The Mint Budget App stands out as a trusted resource for financial planning, with millions of users benefiting from its capabilities. Join us as we explore the intricacies of the Mint Budget App and learn how to master your finances today.

Table of Contents

- Getting Started with the Mint Budget App

- Key Features of Mint

- Setting Up Your Budget

- Tracking Your Spending

- Achieving Your Financial Goals

- Security and Privacy of Your Data

- User Experience and Reviews

- Conclusion

Getting Started with the Mint Budget App

To begin your journey with the Mint Budget App, follow these simple steps:

- Download the App: The Mint Budget App is available for both iOS and Android devices. Visit the App Store or Google Play Store to download the application.

- Create an Account: Sign up using your email address or connect through your Google account. This process is quick and straightforward.

- Link Your Accounts: To take full advantage of Mint's features, link your bank accounts, credit cards, and any other financial accounts you wish to track.

- Set Your Preferences: Customize your budget categories, spending limits, and financial goals to align with your personal needs.

Key Features of Mint

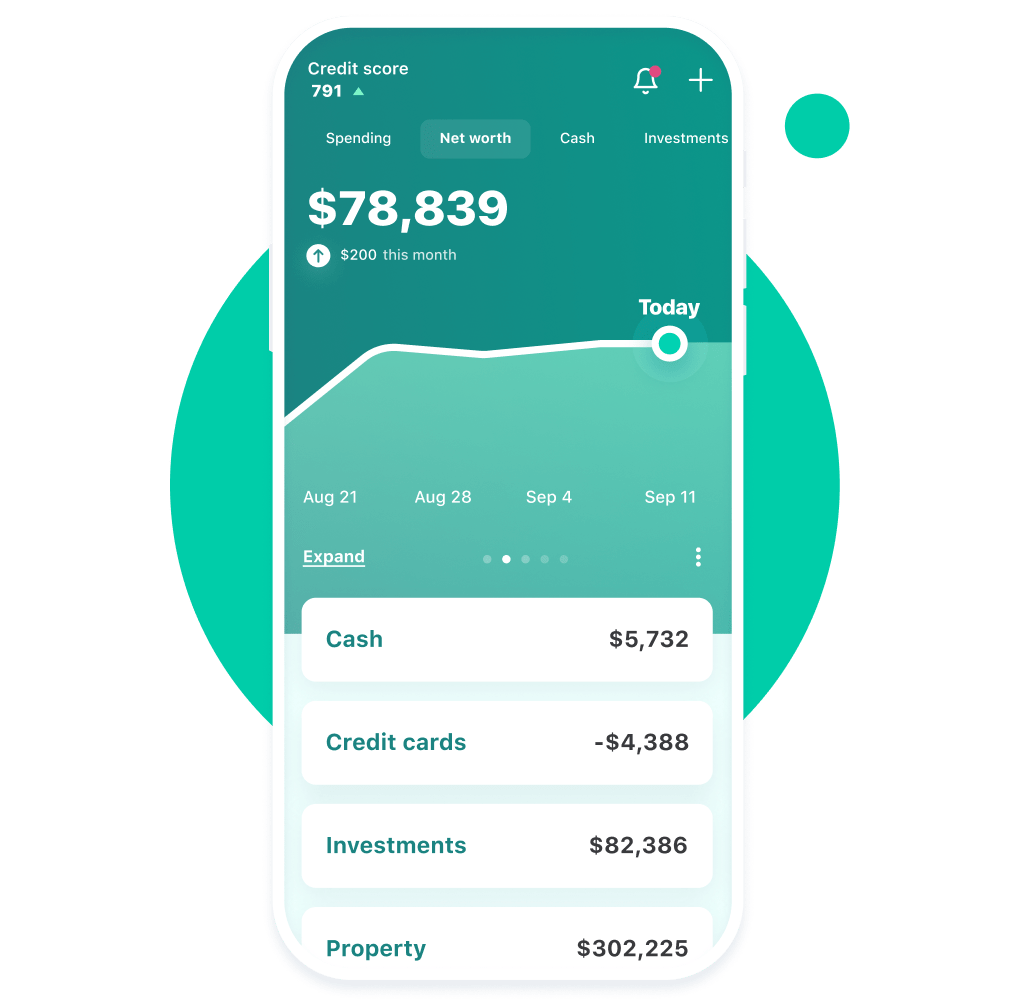

The Mint Budget App is packed with features designed to simplify budgeting and enhance financial awareness. Some of the standout features include:

- Real-time Tracking: Mint allows users to see their transactions in real-time, helping them stay informed about their spending habits.

- Budget Creation: The app provides tools to create personalized budgets based on your income and expenses.

- Spending Insights: Mint analyzes your spending patterns and offers insights and tips for improving your financial health.

- Bill Reminders: Users can set reminders for upcoming bills, ensuring they never miss a payment.

- Credit Score Monitoring: Mint offers free credit score monitoring, allowing users to track their credit health over time.

Linking Your Financial Accounts

Linking your financial accounts to Mint is a crucial step in maximizing the app's capabilities. The app supports a wide range of financial institutions, making it easy to consolidate your finances in one place. Once linked, Mint automatically categorizes your transactions, providing a comprehensive overview of your spending habits.

Setting Up Your Budget

Creating a budget is a fundamental aspect of financial management. The Mint Budget App streamlines this process through its intuitive budgeting tools. Here's how to set up your budget:

- Select Budget Categories: Choose categories that reflect your spending habits, such as groceries, entertainment, and transportation.

- Set Spending Limits: Assign a monthly spending limit to each category based on your financial goals and income.

- Track Your Progress: Regularly monitor your spending within each category to stay on track and make necessary adjustments.

Tracking Your Spending

One of the most powerful features of the Mint Budget App is its ability to track spending effortlessly. The app automatically categorizes transactions, making it easy to see where your money goes. Here are some tips for effective spending tracking:

- Review Monthly Reports: At the end of each month, review your spending reports to identify areas for improvement.

- Set Spending Alerts: Use alerts to notify you when you're approaching your budget limits, helping you to stay within your financial boundaries.

- Analyze Trends: Mint provides visual graphs and charts that highlight spending trends over time, helping you understand your financial behavior.

Achieving Your Financial Goals

Setting and achieving financial goals is essential for long-term financial health. The Mint Budget App allows users to set specific goals, whether it's saving for a vacation, paying off debt, or building an emergency fund. To effectively achieve your financial goals:

- Define Clear Goals: Be specific about what you want to achieve and set realistic timelines.

- Track Your Progress: Use Mint’s goal tracking feature to monitor your progress and celebrate milestones along the way.

- Adjust as Necessary: Life circumstances may change, so be flexible and adjust your goals as needed.

Security and Privacy of Your Data

When it comes to financial apps, security is a top concern for users. Mint takes data security seriously, employing bank-level encryption and security measures to protect your information. Here are some key points regarding security:

- Encryption: Mint uses 256-bit AES encryption to safeguard your data from unauthorized access.

- Two-Factor Authentication: Users can enable two-factor authentication for an added layer of security when logging in.

- Privacy Controls: Mint does not sell your personal information to third parties, ensuring your data remains private.

User Experience and Reviews

The Mint Budget App has received positive reviews from users across various platforms. Many appreciate its ease of use, comprehensive features, and ability to help them regain control over their finances. Here are some common user sentiments:

- User-Friendly Interface: Users find the app's layout intuitive and easy to navigate, making budgeting less daunting.

- Comprehensive Financial Overview: The ability to see all accounts in one place is a major benefit for users.

- Effective Budgeting Tools: Many users report that Mint has significantly improved their budgeting skills and financial awareness.

Conclusion

In conclusion, the Mint Budget App is a powerful financial management tool that can help users take control of their finances. With its wide range of features, including real-time tracking, budget creation, and goal setting, Mint empowers users to make informed financial decisions. By following the tips outlined in this article, you can maximize the app's potential and work towards achieving your financial goals.

We encourage you to explore the Mint Budget App and start your journey towards better financial health today. Share your thoughts in the comments below, and don't forget to check out our other articles for more financial tips and advice!

Thank you for reading, and we look forward to seeing you again soon!

Two Doors Down: A Comprehensive Insight Into The Popular Comedy Series

Rhea Durham: The Journey Of A Model And Entrepreneur

Best Waiver Wire Pickups Week 3: Essential Players To Consider