Understanding Netflix Inc. Stock: A Comprehensive Guide

Netflix Inc. stock has become a subject of great interest for investors and market analysts alike. Over the past decade, Netflix has revolutionized the entertainment industry, paving the way for streaming services and changing how we consume media. This article will delve into the intricacies of Netflix's stock performance, its market position, and what potential investors need to know before making informed decisions.

The world of stock investment can be overwhelming, particularly for newcomers. As a company that has consistently pushed the envelope in terms of content delivery and technological innovation, Netflix's stock offers various opportunities and risks. This article aims to provide a thorough understanding of Netflix Inc. stock, covering its historical performance, current market trends, and future prospects.

In this guide, we will explore the factors influencing Netflix's stock price, including competitive dynamics, financial health, and subscriber growth. By the end of this article, you will be equipped with the knowledge needed to navigate the complexities of investing in Netflix Inc. stock.

Table of Contents

- What is Netflix Inc.?

- Historical Performance of Netflix Inc. Stock

- Market Analysis: Current Trends

- Financial Health and Key Metrics

- Competitive Landscape in the Streaming Industry

- Future Prospects for Netflix Inc. Stock

- Investing Tips for Netflix Inc. Stock

- Conclusion

What is Netflix Inc.?

Netflix Inc. is a leading streaming service provider founded in 1997 by Reed Hastings and Marc Randolph. Initially, the company operated as a DVD rental service, but it transitioned to streaming in 2007, allowing subscribers to watch a vast library of films and TV shows online. Today, Netflix is a global powerhouse in entertainment, with over 230 million subscribers worldwide as of 2023.

Key Facts About Netflix Inc.

| Detail | Information |

|---|---|

| Founded | 1997 |

| Headquarters | Los Gatos, California, USA |

| CEO | Reed Hastings |

| Industry | Entertainment / Streaming |

| Number of Subscribers | Over 230 million |

Historical Performance of Netflix Inc. Stock

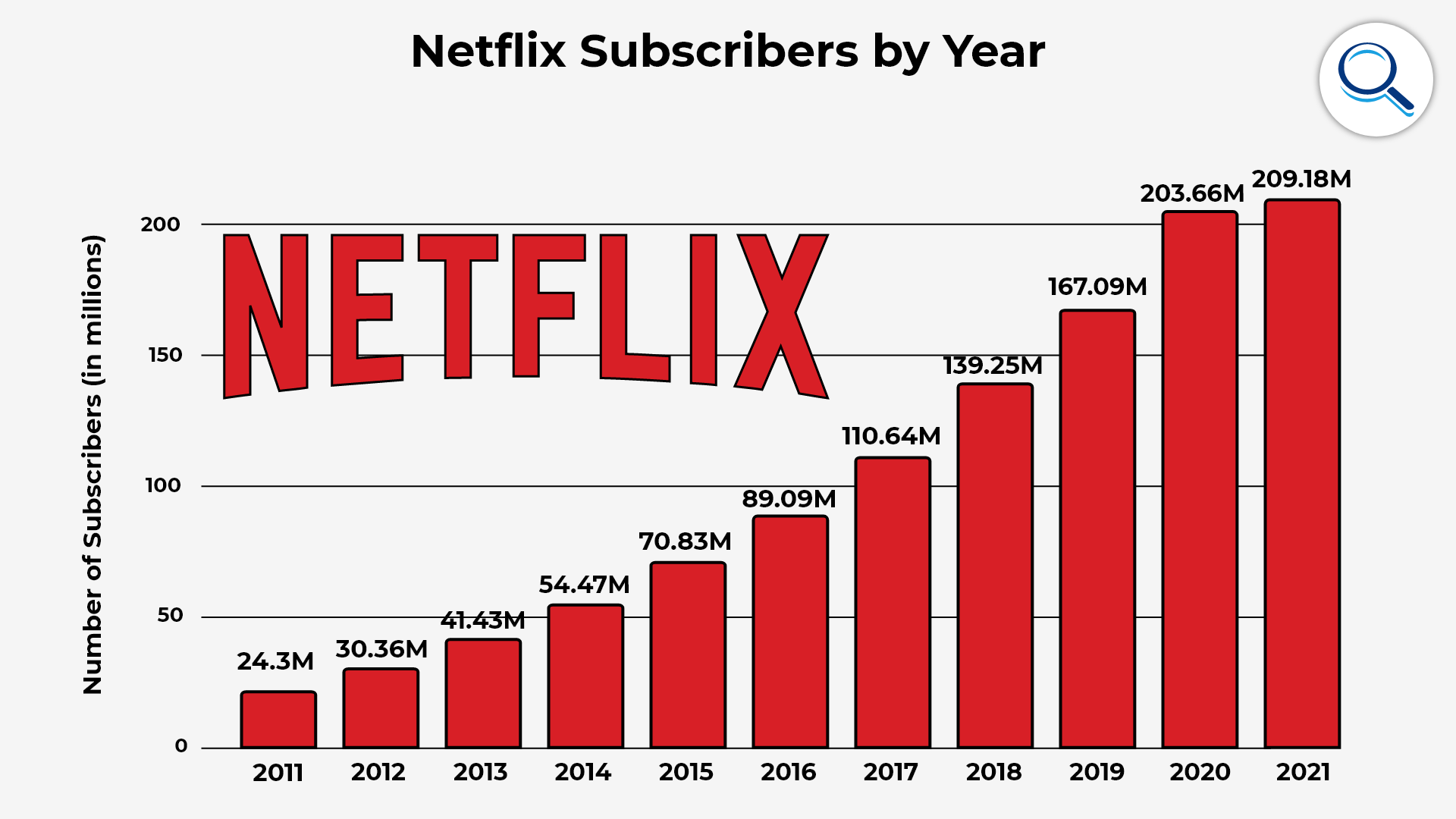

Netflix's stock has experienced significant fluctuations since its initial public offering (IPO) in 2002. The company went public at a price of $15 per share, and as of October 2023, the stock price has soared to over $400. This impressive growth is a testament to Netflix's ability to innovate and adapt to changing consumer preferences.

Key Milestones in Stock Performance

- IPO in 2002: $15 per share

- First major subscriber growth in 2013 with original content

- Stock price peaked at $700 in July 2021

- Recent fluctuations due to market conditions and competition

Market Analysis: Current Trends

The streaming market is becoming increasingly competitive, with numerous players vying for consumer attention. Companies like Amazon Prime, Disney+, and Hulu have emerged as formidable challengers to Netflix's dominance. As a result, Netflix has had to adapt its strategies to maintain its market share.

Recent Trends Affecting Netflix Inc. Stock

- Increased competition leading to subscriber growth challenges

- Investment in original content to retain subscribers

- Global expansion efforts in emerging markets

Financial Health and Key Metrics

To assess the viability of investing in Netflix Inc. stock, it is crucial to examine the company's financial health. Key metrics to consider include revenue growth, profitability, and cash flow.

Key Financial Metrics

- Annual Revenue: $30 billion (2022)

- Net Income: $5 billion (2022)

- Subscriber Growth Rate: 8% YoY

Competitive Landscape in the Streaming Industry

The streaming industry is marked by rapid changes, with new entrants and evolving consumer preferences reshaping the landscape. Netflix must navigate this environment carefully to maintain its leading position.

Major Competitors

- Amazon Prime Video

- Disney+

- Hulu

- HBO Max

Future Prospects for Netflix Inc. Stock

Looking ahead, the future for Netflix Inc. stock appears to be tied to its ability to innovate and adapt to market changes. The company's investment in original content and global expansion will play a critical role in attracting and retaining subscribers.

Key Factors Influencing Future Growth

- Content diversification and quality

- Emerging markets expansion

- Technological advancements in streaming

Investing Tips for Netflix Inc. Stock

Investing in Netflix Inc. stock can be rewarding, but it requires careful consideration and research. Here are some tips for potential investors:

- Keep an eye on subscriber growth trends.

- Monitor financial health through quarterly earnings reports.

- Diversify your portfolio to mitigate risks.

- Stay informed about industry developments and competitor strategies.

Conclusion

In summary, Netflix Inc. stock presents both opportunities and challenges for investors. Understanding the company's historical performance, current market dynamics, and future prospects is essential for making informed investment decisions. As the streaming landscape continues to evolve, Netflix's ability to adapt will ultimately determine its success in the market.

We encourage readers to share their thoughts and experiences regarding Netflix Inc. stock in the comments below. If you found this article helpful, consider sharing it with others or exploring more articles on our site about stock investments and market analysis.

Final Thoughts

Thank you for taking the time to read this comprehensive guide on Netflix Inc. stock. We hope to see you back on our site for more insightful articles that can help you on your investment journey.

Atlanta Braves Vs Yankees Match Player Stats: An In-Depth Analysis

Ark Ascension: A Comprehensive Guide To Survival And Adventure

CrowdStrike Stock: An In-Depth Analysis On Yahoo Finance