Understanding Stock Splits In 2024: A Comprehensive Guide

Stock splits are a crucial aspect of the stock market that every investor should understand, especially as we move into 2024. In the world of investing, stock splits can significantly impact share prices and investor sentiment. Companies often opt for stock splits to make their shares more affordable for a broader range of investors. This article will explore the concept of stock splits, their implications in 2024, and how they can affect your investment strategy.

In this guide, we will delve into the mechanics of stock splits, the reasons companies choose to split their stocks, and what investors should consider in light of upcoming stock splits in 2024. We will also provide valuable insights and data to help you make informed decisions regarding your investments. Understanding stock splits is essential for anyone looking to navigate the stock market effectively.

So, whether you are a seasoned investor or just starting, this comprehensive overview will equip you with the knowledge you need to understand stock splits in 2024 and how they may influence your portfolio. Let’s dive into the details.

Table of Contents

- What is a Stock Split?

- Reasons for Stock Splits

- Impact on Share Price

- Investing Strategies Post-Split

- Historical Stock Splits and Trends

- Stock Splits in 2024

- Case Studies of Notable Stock Splits

- Conclusion

What is a Stock Split?

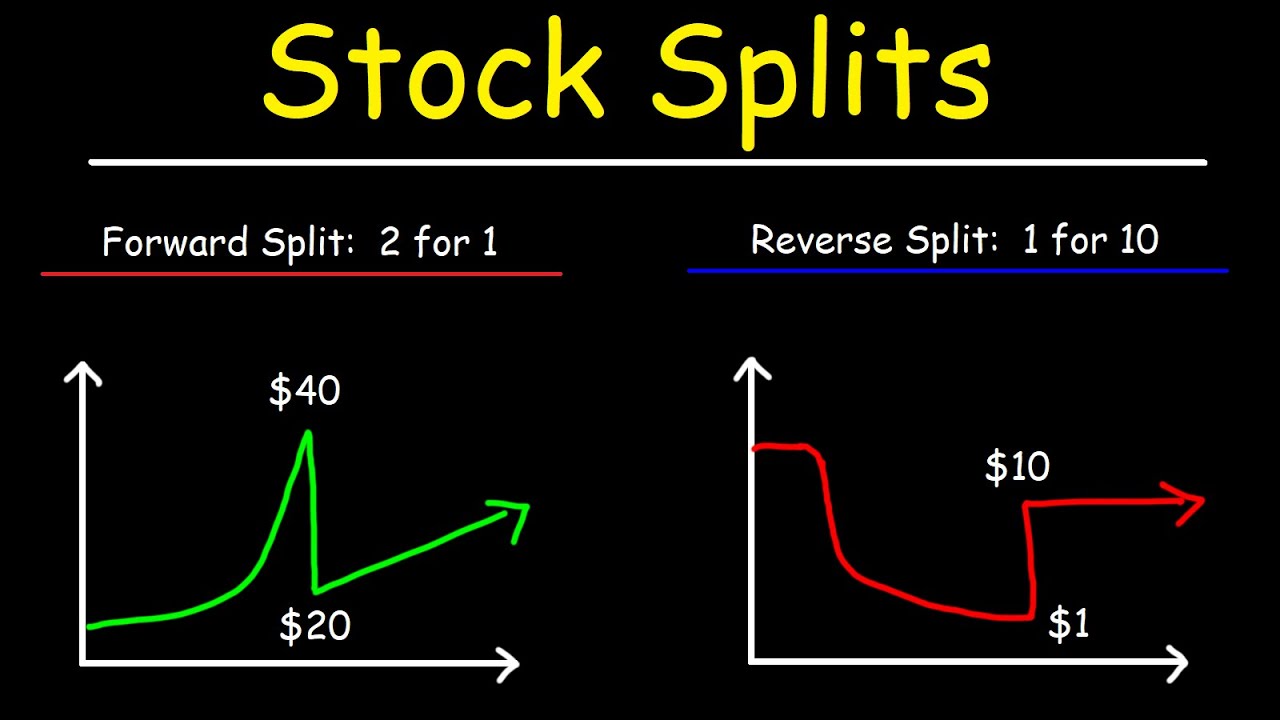

A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost liquidity. For example, in a 2-for-1 stock split, each shareholder will receive an additional share for every share they own, effectively doubling the number of shares while halving the stock price. This does not alter the overall market capitalization of the company but makes shares more affordable for retail investors.

Types of Stock Splits

- Forward Stock Split: This is the most common type, where a company increases the number of shares while reducing the price.

- Reverse Stock Split: In this case, a company consolidates its shares, reducing the total number of shares and increasing the share price.

Reasons for Stock Splits

Companies may choose to split their stocks for various reasons, including:

- Improving Liquidity: By reducing the stock price, more investors can afford to buy shares, increasing trading volume.

- Attracting Retail Investors: Lower share prices can entice small investors who may feel priced out of higher-priced stocks.

- Maintaining a Competitive Share Price: Companies may want to keep their stock price within a certain range for market perception.

Impact on Share Price

While stock splits do not change a company's fundamental value, they can influence share prices in the following ways:

- Initial Price Drop: Following a split, the share price usually drops, making it more attractive to investors.

- Post-Split Momentum: Historically, stocks that have undergone splits often see a price increase in the months following the split.

Investing Strategies Post-Split

After a stock split, it's essential for investors to adapt their strategies accordingly:

- Monitor Performance: Keep an eye on how the stock performs post-split to make informed decisions.

- Diversify: Consider diversifying your portfolio to mitigate risks associated with stock splits.

Historical Stock Splits and Trends

Understanding historical stock splits can provide valuable insights into potential future performance. For instance:

- Companies like Apple and Tesla have experienced significant stock price increases following their splits.

- Statistical analyses often show that stocks tend to outperform the market in the year following a split.

Stock Splits in 2024

As we look ahead to 2024, several companies are anticipated to announce stock splits. Keep an eye on the following stocks:

- Company A: Expected to split shares in Q2 2024.

- Company B: Rumored to announce a split in Q3 2024.

Staying informed about these potential splits can help investors position themselves advantageously.

Case Studies of Notable Stock Splits

Let’s examine a few notable case studies of companies that have recently undergone stock splits:

- Apple Inc. (AAPL): Conducted a 4-for-1 split in 2020, resulting in significant price appreciation.

- Tesla Inc. (TSLA): Completed a 5-for-1 split in 2020, leading to increased investor interest and stock performance.

Conclusion

In summary, understanding stock splits is vital for navigating the stock market effectively, especially as we approach 2024. Stock splits can create opportunities for investors, and being informed about upcoming splits can provide a strategic advantage. Remember to analyze the reasons behind a split and consider how it fits into your overall investment strategy. We encourage you to share your thoughts in the comments below and explore more articles on our site for further insights into investing.

Thank you for reading! We hope you found this guide informative and helpful. Be sure to return for more insights and updates on the stock market.

Eagles Vs Chiefs: A Comprehensive Analysis Of The NFL Showdown

Chris Herren: The Inspiring Journey Of A Basketball Star Turned Recovery Advocate

Quickest 0-60 Cars: Unleashing Speed And Power