Understanding CVNA Stock Price: Trends, Analysis, And Future Outlook

The CVNA stock price has gained significant attention in the investment community due to its unique business model and market position. As a leading online used car retailer, Carvana Co. (CVNA) has revolutionized the way consumers buy and sell vehicles, leveraging technology to streamline the process. This article delves into the intricacies of CVNA stock price, exploring its historical performance, market trends, and future prospects.

In the following sections, we will analyze various factors that influence CVNA's stock performance, including market competition, financial health, and investor sentiment. We will also provide insights into recent developments and how they may affect the stock price moving forward. Whether you're a seasoned investor or just starting, understanding CVNA's dynamics is crucial for making informed decisions.

Join us as we navigate through the complexities of CVNA's stock price, backed by data, expert opinions, and market forecasts. With a comprehensive overview, you will be better equipped to assess the opportunities and risks associated with investing in Carvana Co.

Table of Contents

- 1. Overview of Carvana Co.

- 2. Historical Performance of CVNA Stock

- 3. Factors Influencing CVNA Stock Price

- 4. Financial Analysis of Carvana

- 5. Market Trends Affecting CVNA

- 6. Future Outlook for CVNA Stock Price

- 7. Expert Opinions and Market Sentiment

- 8. Conclusion and Takeaways

1. Overview of Carvana Co.

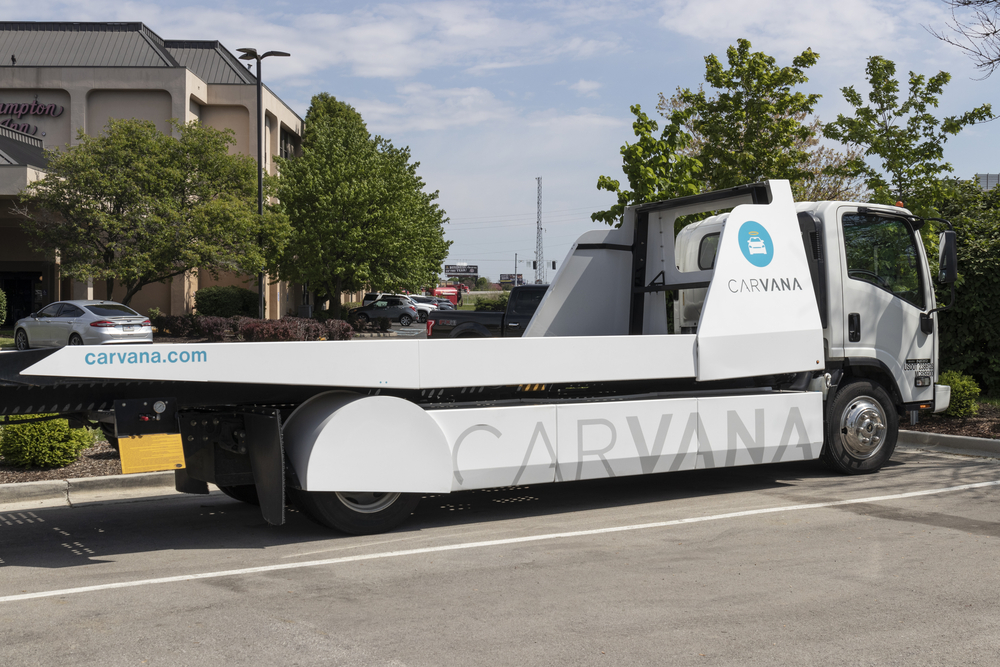

Carvana Co. is an innovative online platform that specializes in buying and selling used cars. Founded in 2012, the company has rapidly expanded its operations across the United States, offering a unique car-buying experience with features such as home delivery and a 7-day return policy.

1.1 Company Mission and Vision

Carvana aims to transform the traditional car buying process by making it more convenient and transparent for consumers. The company’s mission is to provide an easy, fast, and enjoyable way to buy used cars online.

1.2 Business Model

Carvana's business model leverages technology and data analytics to optimize inventory management, pricing strategies, and customer engagement. This approach has allowed the company to maintain a competitive edge in the growing online automotive market.

2. Historical Performance of CVNA Stock

The historical performance of CVNA stock is crucial for understanding its current market position. Since its IPO in April 2017, the stock has experienced significant volatility, reflecting both the growth potential and challenges faced by the company.

2.1 IPO and Initial Performance

Carvana went public at a price of $15 per share, and the stock saw an initial surge, driven by investor enthusiasm for its innovative approach to the used car market. However, the stock also faced corrections as market realities set in.

2.2 Recent Performance Trends

In recent years, CVNA stock has experienced fluctuations influenced by broader market trends, quarterly earnings reports, and shifts in consumer behavior. Tracking these trends is essential for investors looking to understand potential future movements in the stock price.

3. Factors Influencing CVNA Stock Price

Various factors contribute to the fluctuations in CVNA stock price. Understanding these factors can help investors make informed decisions.

3.1 Market Competition

- Online competitors like Vroom and CarGurus

- Traditional dealerships adapting to online sales

- The impact of consumer preferences shifting towards e-commerce

3.2 Economic Conditions

- Interest rates and their effect on auto loans

- Consumer spending trends

- Economic recovery post-pandemic

4. Financial Analysis of Carvana

A thorough financial analysis is critical in assessing the health of Carvana and its stock price. Key financial indicators include revenue growth, profit margins, and cash flow.

4.1 Revenue Growth

Carvana has experienced robust revenue growth, driven by increased sales volume and expansion into new markets. Analyzing quarterly earnings reports can provide insights into ongoing growth trajectories.

4.2 Profitability Metrics

- Gross margin trends

- Net income and losses over recent quarters

- Comparison with industry benchmarks

5. Market Trends Affecting CVNA

Understanding broader market trends is essential for predicting CVNA stock price movements. Key trends include shifts in consumer behavior, technological advancements, and regulatory changes.

5.1 Shifts in Consumer Behavior

The COVID-19 pandemic has accelerated the shift towards online shopping, with more consumers opting to purchase vehicles online. This trend is likely to continue, benefiting companies like Carvana.

5.2 Technological Advancements

- Enhancements in online car-buying platforms

- Integration of AI and machine learning for customer engagement

- Innovations in vehicle delivery and customer service

6. Future Outlook for CVNA Stock Price

The future outlook for CVNA stock price is contingent on several factors, including market conditions, internal business strategies, and economic indicators.

6.1 Analyst Predictions

Market analysts provide varying predictions for CVNA stock price, influenced by different assumptions about market growth and Carvana’s strategic initiatives.

6.2 Long-Term Growth Potential

- Expansion into new geographic markets

- Enhancement of technology-driven services

- Strategic partnerships and collaborations

7. Expert Opinions and Market Sentiment

Expert opinions and market sentiment play a crucial role in influencing investor decisions regarding CVNA stock. Insights from financial analysts and market research studies can provide valuable context.

7.1 Analyst Ratings

Examining analyst ratings and their rationale can help investors gauge the sentiment surrounding CVNA stock.

7.2 Investor Sentiment Analysis

- Social media trends and discussions

- Sentiment analysis tools and their findings

- Influence of major investors on stock price movements

8. Conclusion and Takeaways

In conclusion, understanding CVNA stock price requires a multifaceted approach that considers historical performance, market trends, financial health, and expert opinions. As the online used car market continues to evolve, Carvana’s innovative business model positions it well for future growth.

Investors are encouraged to stay informed about market developments and consider their risk tolerance when making investment decisions. For more insights, feel free to leave comments, share this article, or explore other related content on our website.

Thank you for reading! We look forward to providing you with more valuable information in the future.

BA Stock Price Today: A Comprehensive Analysis Of Boeing's Market Performance

Kaitlin Doubleday: A Comprehensive Look At The Actress And Her Career

Exploring NDX: A Comprehensive Guide To The Nasdaq-100 Index