American Express (NYSE: AXP): A Comprehensive Overview Of Its Business Model And Market Position

American Express (NYSE: AXP) is a prominent financial services corporation known for its charge card, credit card, and traveler's cheque businesses. With a history that spans over a century, American Express has established itself as a leader in the financial services sector. This article delves into the company's business model, its competitive advantages, and the market dynamics that shape its operations. As we explore the various facets of American Express, we will also highlight key statistics and trends that define its current position in the financial landscape.

The company operates within a highly competitive industry, facing challenges from both traditional banks and emerging fintech companies. However, American Express has managed to sustain its growth through innovation and strategic partnerships. In this article, we will discuss the company's various products and services, its customer base, and the impact of global economic trends on its performance.

Furthermore, we will examine the financial health of American Express by analyzing its stock performance and market capitalization. With insights drawn from reputable sources, this article aims to provide a thorough understanding of American Express, making it a valuable resource for both investors and consumers interested in the financial services sector.

Table of Contents

- Biography of American Express

- Understanding the Business Model of American Express

- Financial Products and Services Offered

- Target Customer Base of American Express

- Market Position and Competitive Advantages

- Financial Performance and Stock Analysis

- Impact of Global Economic Trends

- Conclusion

Biography of American Express

Founded in 1850, American Express began as an express mail business in Buffalo, New York. Over the years, the company evolved into a leading provider of charge cards and credit cards. Today, it operates in over 130 countries, serving millions of customers worldwide.

| Data | Details |

|---|---|

| Founded | 1850 |

| Headquarters | New York City, New York, USA |

| CEO | Stephen Squeri |

| Market Capitalization | Approximately $100 billion (as of 2023) |

Understanding the Business Model of American Express

American Express operates on a unique business model that combines several revenue streams:

- **Charge Cards and Credit Cards**: The core of its business, generating annual fees and transaction fees.

- **Merchant Services**: American Express charges merchants a fee for processing card transactions.

- **Travel Services**: The company offers travel-related products and services, including travel insurance and vacation packages.

- **Loyalty Programs**: The Membership Rewards program incentivizes customers to use American Express cards, enhancing customer loyalty.

The company's ability to diversify its revenue sources has allowed it to remain resilient in the face of economic fluctuations.

Financial Products and Services Offered

American Express provides a range of financial products catering to both individuals and businesses:

Personal Financial Products

- **Personal Charge Cards**: Designed for individuals who pay their balance in full each month.

- **Credit Cards**: Offering revolving credit facilities with various rewards programs.

- **Prepaid Cards**: Providing a secure way to spend without incurring debt.

Business Financial Products

- **Business Charge Cards**: Tailored for small and medium-sized enterprises to manage expenses.

- **Corporate Cards**: Designed for larger organizations to streamline travel and entertainment expenses.

- **Expense Management Tools**: Helping businesses track and manage their spending efficiently.

Target Customer Base of American Express

American Express primarily targets affluent individuals and businesses. The company has cultivated a reputation for catering to high-income consumers who value premium services and exclusive benefits.

- **Affluent Consumers**: Individuals with a high disposable income who prioritize rewards and customer service.

- **Small to Medium Enterprises (SMEs)**: Businesses looking for expense management solutions and credit options.

- **Travel Enthusiasts**: Customers who frequently travel and seek travel-related benefits and rewards.

Market Position and Competitive Advantages

American Express holds a strong position in the financial services industry due to its brand reputation, customer loyalty, and innovative offerings. Some of its competitive advantages include:

- **Strong Brand Recognition**: American Express is synonymous with premium financial services.

- **Customer Loyalty**: The Membership Rewards program fosters long-term relationships with cardholders.

- **Innovative Technology**: The company invests in technology to enhance customer experiences and streamline operations.

Despite facing competition from Visa, Mastercard, and emerging fintech solutions, American Express continues to thrive by focusing on its core strengths.

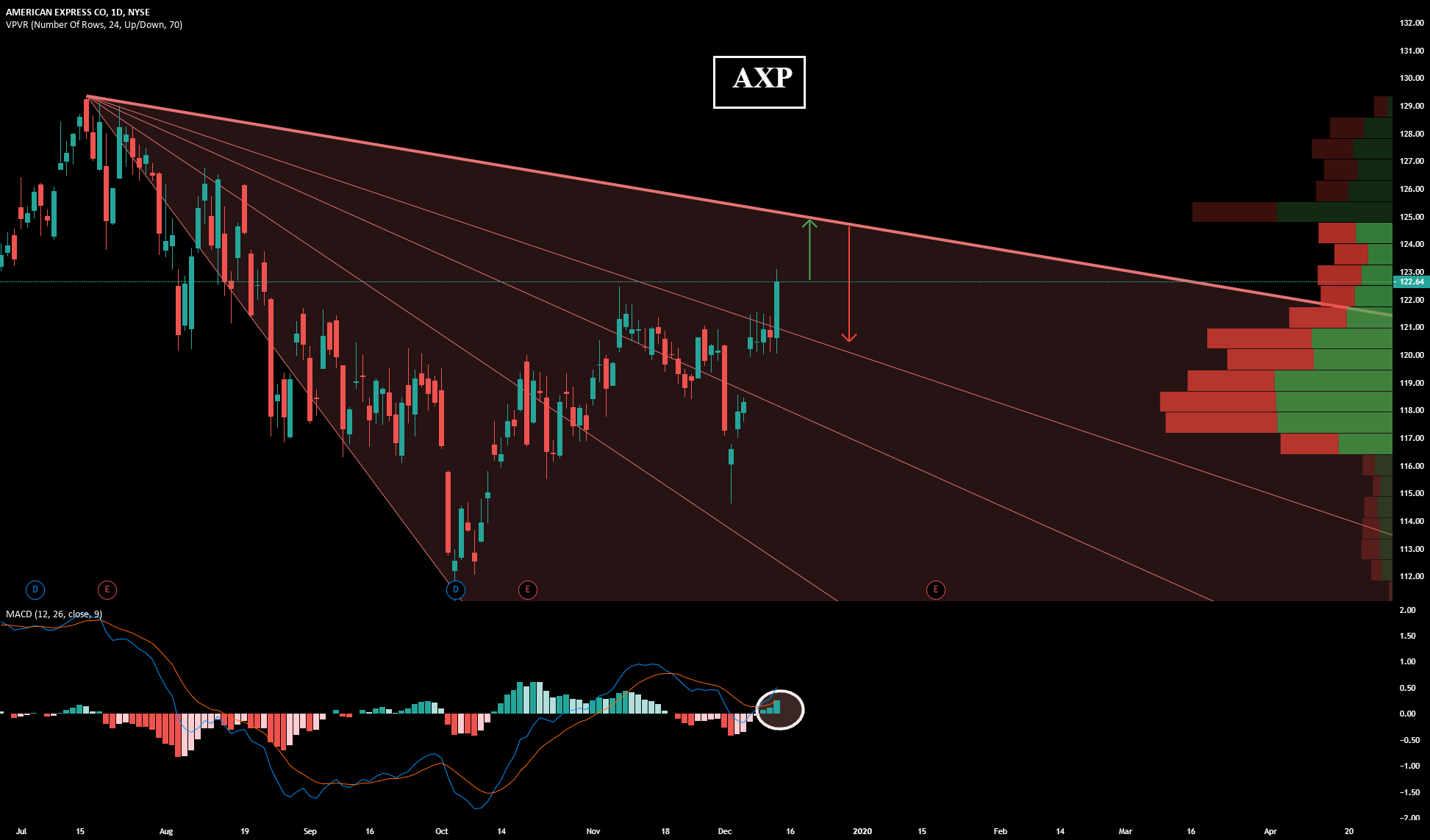

Financial Performance and Stock Analysis

American Express has demonstrated consistent financial performance over the years. Key metrics include:

- **Revenue Growth**: The company reported a revenue increase of 20% year-over-year in 2022.

- **Net Income**: A net income of approximately $6.5 billion was recorded in 2022.

- **Stock Performance**: American Express shares have delivered a return of over 15% in the past year.

Investors often view American Express as a stable investment due to its strong financial health and consistent dividend payouts.

Impact of Global Economic Trends

American Express's performance is closely tied to global economic trends. Factors such as consumer spending, interest rates, and international trade significantly impact its operations:

- **Consumer Spending**: Increased consumer spending leads to higher transaction volumes, benefiting American Express.

- **Interest Rates**: Fluctuating interest rates affect borrowing costs and consumer credit demand.

- **Global Trade**: International travel and trade influence the company’s travel-related services.

Conclusion

In summary, American Express (NYSE: AXP) is a leading player in the financial services industry, with a robust business model and a strong market position. Its commitment to customer service, innovative products, and strategic partnerships has enabled it to maintain a competitive edge. As the company navigates the complexities of the global economy, it remains a trusted choice for consumers and businesses alike.

We invite you to share your thoughts about American Express in the comments section below. For more insights into financial services, feel free to explore other articles on our website.

Thank you for reading, and we hope to see you back soon for more informative content!

Understanding Federal Loan Servicing: A Comprehensive Guide

Anderson Cooper Net Worth: A Comprehensive Look At The Wealth Of A CNN Icon

Top Gun Maverick Cast: A Deep Dive Into The Stars Of The Blockbuster Sequel