Understanding CAT Stock Price: A Comprehensive Guide To Caterpillar Inc. Financial Performance

CAT stock price has been a topic of interest for investors and market analysts alike. As one of the leading manufacturers of construction and mining equipment, Caterpillar Inc. (NYSE: CAT) plays a crucial role in the global economy. This article will delve into the factors influencing CAT stock price, how it compares to industry peers, and what investors can expect moving forward. Whether you're a seasoned investor or just dipping your toes into the stock market, understanding CAT stock price trends is essential for making informed decisions.

In this comprehensive guide, we will explore the financial performance of Caterpillar Inc., analyze market trends, and discuss various elements that impact its stock price. Understanding the nuances of CAT stock price can empower investors to make strategic choices that align with their financial goals. By the end of this article, you will have a well-rounded understanding of what drives CAT stock price and how to interpret market signals.

As we proceed, we will cover several key topics, including Caterpillar’s historical stock performance, industry comparisons, and expert insights into future projections. With an emphasis on data-driven analysis, we will ensure that our findings are backed by credible sources and statistics. So let's dive into the world of CAT stock price and uncover what makes it a fascinating subject for investors!

Table of Contents

- Caterpillar Inc. Biography

- Historical Performance of CAT Stock Price

- Factors Influencing CAT Stock Price

- CAT Stock Price vs. Industry Peers

- Future Outlook for CAT Stock Price

- Investment Strategies for CAT Stock

- Expert Insights on CAT Stock Price

- Conclusion

Caterpillar Inc. Biography

Caterpillar Inc. is an American corporation that designs, manufactures, markets, and sells machinery and engines. Founded in 1925, the company has established itself as a leader in the construction and mining industries. Below is a brief overview of the company's key information:

| Detail | Information |

|---|---|

| Founded | 1925 |

| Headquarters | Deerfield, Illinois, USA |

| CEO | Jim Umpleby |

| Industry | Construction and Mining Equipment |

| Stock Symbol | CAT |

Historical Performance of CAT Stock Price

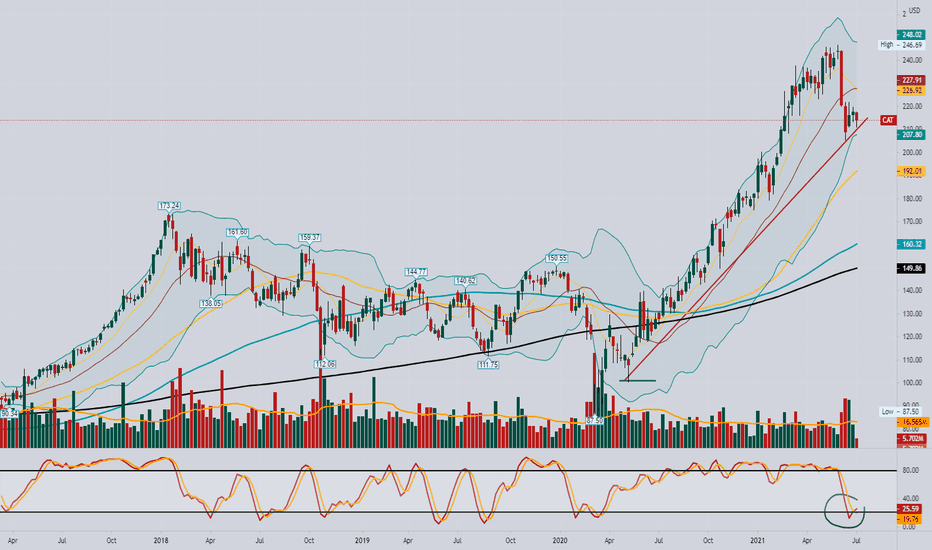

Caterpillar's stock price has seen significant fluctuations over the years, influenced by various economic factors and market conditions. In this section, we will analyze its historical performance to provide context for current price movements.

1. Early Years and Growth

During the early years following its establishment, Caterpillar focused on expanding its product range and improving operational efficiencies. The stock price steadily increased as the company gained market share and established a strong brand reputation.

2. Economic Downturns and Recovery

Like many industrial companies, Caterpillar faced challenges during economic downturns, particularly during the 2008 financial crisis. The stock price experienced a sharp decline but rebounded as the economy recovered. This cyclical nature of the stock is crucial for investors to understand.

Factors Influencing CAT Stock Price

Several factors can influence CAT stock price, including:

- Global Economic Conditions: Economic growth in construction and mining sectors can drive demand for Caterpillar’s products, affecting stock price.

- Commodity Prices: Fluctuations in commodity prices, like oil and metals, can impact Caterpillar's sales and profitability.

- Interest Rates: Changes in interest rates can affect capital expenditures in the construction industry, influencing Caterpillar's performance.

- Geopolitical Events: Trade policies, tariffs, and geopolitical tensions can have a significant impact on Caterpillar's international operations and stock price.

CAT Stock Price vs. Industry Peers

Understanding how CAT stock price compares to its industry peers can provide valuable insights for investors. In this section, we will compare Caterpillar’s performance with other major players in the construction and mining equipment sector.

1. Key Competitors

- Komatsu Ltd. (OTC: KMTUY)

- Hitachi Construction Machinery Co., Ltd. (OTC: HTHIY)

- Volvo Group (OTC: VLVLY)

2. Performance Metrics

Using performance metrics such as P/E ratio, market capitalization, and earnings growth, we can analyze how CAT stock stands against its competitors. For instance:

- Caterpillar’s P/E ratio is currently around 20, which is competitive compared to its peers.

- The company has shown consistent earnings growth, contributing to its strong market position.

Future Outlook for CAT Stock Price

Looking ahead, several trends and forecasts could impact CAT stock price:

- Infrastructure Spending: Increased government spending on infrastructure projects can boost demand for Caterpillar's products.

- Sustainable Practices: The shift towards sustainable construction methods may create new opportunities for Caterpillar.

- Technological Advancements: Innovations in machinery and automation could enhance Caterpillar’s competitive edge.

Investment Strategies for CAT Stock

Investors considering CAT stock should evaluate their investment strategies based on risk tolerance and market conditions. Here are some strategies to consider:

- Long-Term Investment: Investing in CAT stock for the long term can be a sound strategy, given its historical resilience.

- Diversification: Including CAT stock in a diversified portfolio can mitigate risks associated with market volatility.

- Monitoring Market Trends: Staying informed about economic indicators and industry trends can help in making timely investment decisions.

Expert Insights on CAT Stock Price

To provide additional depth, we consulted industry experts for their perspectives on CAT stock price trends:

- Analysts project steady growth in CAT stock price due to increasing global infrastructure investments.

- Experts recommend a cautious approach, considering potential economic uncertainties that could affect the stock.

Conclusion

In summary, understanding CAT stock price involves analyzing historical performance, influencing factors, and industry comparisons. As Caterpillar continues to adapt to changing market conditions and consumer demands, investors should remain vigilant and informed. We encourage readers to explore further, engage in discussions, and share insights with fellow investors. Your financial journey is unique, and staying informed is key to making the right decisions.

If you found this article helpful, please leave a comment below or share it with others interested in stock market insights. For more articles on investment strategies and market analysis, don’t forget to check out our other resources!

Thank you for reading, and we look forward to welcoming you back for more insightful content on finance and investments!

Wedding Crashers: The Ultimate Guide To Understanding The Phenomenon

Understanding BNE Stock: Insights, Analysis, And Investment Strategies

Understanding SMH Stock: A Comprehensive Guide To Investing In Semiconductor ETFs