Understanding Fractional Banking: A Comprehensive Guide To Its Mechanisms And Impact

Fractional banking is a pivotal concept in the financial sector, playing a crucial role in how banks operate and influence the economy. It allows banks to lend more money than they actually hold in deposits, effectively creating money through the credit system. This article aims to delve into the intricacies of fractional banking, its implications, and its significance in today's economic landscape.

The concept of fractional banking is not just a technical term but a fundamental principle that shapes the way individuals and businesses interact with financial institutions. By understanding how fractional banking works, you can make more informed decisions regarding savings, loans, and investments. This article will explore the mechanisms of fractional banking, its benefits and drawbacks, and how it affects the overall financial system.

As we navigate through this article, we will address various aspects of fractional banking, including its history, the process involved, and its implications for consumers and the economy. Whether you're a student of finance, a business owner, or simply someone interested in understanding how banks operate, this guide aims to provide valuable insights into fractional banking.

Table of Contents

- 1. What is Fractional Banking?

- 2. The Mechanics of Fractional Banking

- 3. Historical Context of Fractional Banking

- 4. Benefits of Fractional Banking

- 5. Drawbacks of Fractional Banking

- 6. Fractional Banking and the Global Economy

- 7. Regulatory Framework Surrounding Fractional Banking

- 8. Future of Fractional Banking

1. What is Fractional Banking?

Fractional banking refers to a banking system in which banks keep a fraction of deposits as reserves and lend out the remainder. This system allows banks to create money in the economy, as they can issue loans that exceed the actual cash deposits they hold. The reserve requirement is determined by central banks, which dictates the minimum amount of funds banks must hold in reserve against deposits.

1.1 Key Characteristics of Fractional Banking

- Money Creation: Banks can lend more than they hold in actual deposits, effectively creating new money.

- Reserve Ratio: The percentage of deposits that banks are required to keep in reserve, set by the central bank.

- Interbank Lending: Banks can borrow from each other to meet reserve requirements.

2. The Mechanics of Fractional Banking

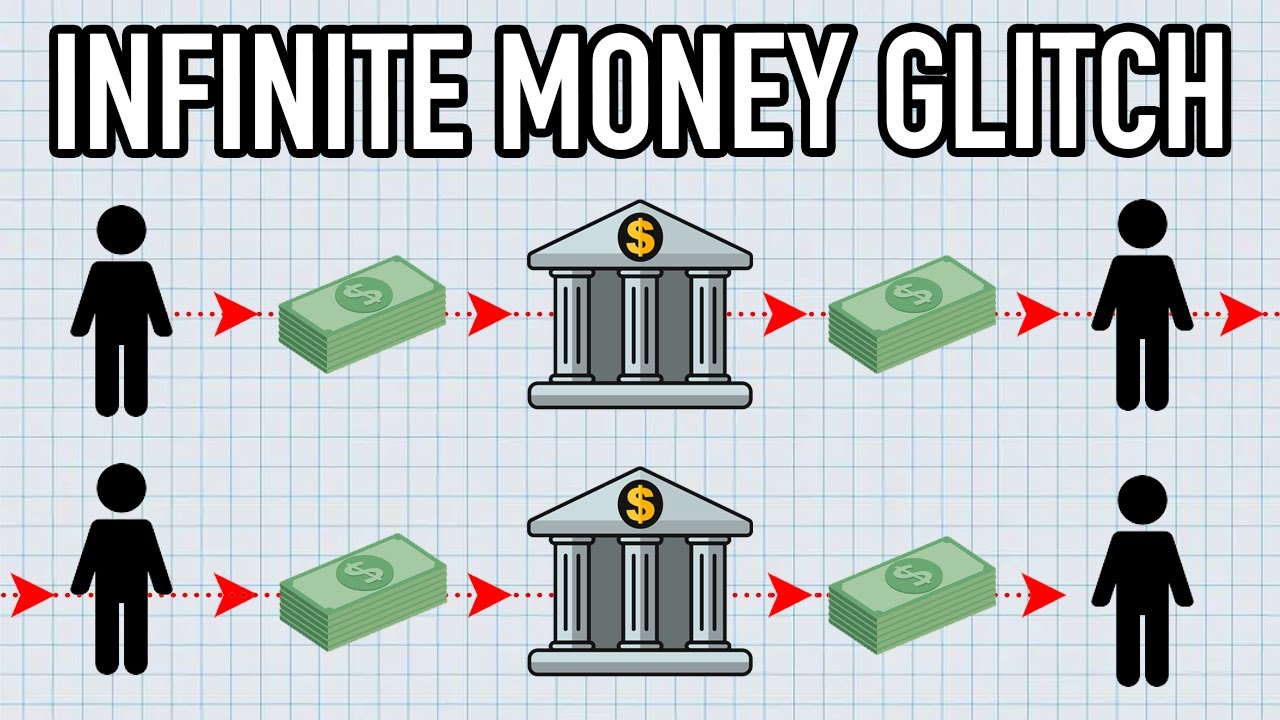

The mechanics of fractional banking involve several key processes. When a customer deposits money into their bank account, the bank is required to keep a certain percentage, known as the reserve ratio, in reserve. The remaining amount can be loaned out to other customers. This process is known as the money multiplier effect.

2.1 The Money Multiplier Effect

The money multiplier effect illustrates how an initial deposit can lead to a larger increase in the total money supply. For example, if a bank has a reserve requirement of 10%, it must keep $10 for every $100 deposited. The remaining $90 can be lent out, and when that $90 is deposited into another bank, it can lend out 90% of that amount as well, and so on. This cycle continues, effectively multiplying the initial deposit.

3. Historical Context of Fractional Banking

Fractional banking has a long history that dates back to the early days of banking. In the 17th century, goldsmiths in England began issuing receipts for gold deposits, which functioned as money. Over time, this led to the development of the modern banking system, where banks began lending more than they held in reserves.

3.1 Evolution of Banking Practices

- Gold Standard: Initially, banks operated under the gold standard, where currency was backed by physical gold.

- Central Banking: The establishment of central banks brought regulation to fractional banking, ensuring stability in the financial system.

4. Benefits of Fractional Banking

Fractional banking offers several benefits, both for banks and the economy as a whole. One of the primary advantages is the ability to facilitate economic growth by providing loans to individuals and businesses.

4.1 Economic Growth and Development

- Increased Lending Capacity: Banks can lend more, leading to greater access to credit for consumers and businesses.

- Stimulating Investment: By providing loans, fractional banking encourages investment in various sectors, driving economic development.

5. Drawbacks of Fractional Banking

Despite its benefits, fractional banking also has its drawbacks. One of the most significant risks is the potential for bank runs, where a large number of customers withdraw their deposits simultaneously, leading to liquidity issues.

5.1 Risks Associated with Fractional Banking

- Bank Runs: A sudden demand for withdrawals can leave banks unable to meet their obligations.

- Inflation: Excessive lending can lead to inflation if the money supply grows faster than the economy.

6. Fractional Banking and the Global Economy

The impact of fractional banking extends beyond individual banks to the global economy. It plays a crucial role in monetary policy and can influence interest rates, inflation, and overall economic stability.

6.1 Monetary Policy Implications

Central banks use fractional banking as a tool to implement monetary policy. By adjusting reserve requirements and interest rates, they can control the money supply and influence economic activity.

7. Regulatory Framework Surrounding Fractional Banking

To mitigate risks associated with fractional banking, regulatory frameworks have been established. These regulations aim to ensure the stability and integrity of the banking system.

7.1 Key Regulations and Authorities

- Basel III: An international regulatory framework aimed at strengthening bank capital requirements and reducing systemic risks.

- FDIC Insurance: In the United States, the Federal Deposit Insurance Corporation insures deposits, protecting consumers in case of bank failures.

8. Future of Fractional Banking

The future of fractional banking is likely to evolve with advancements in technology and changing economic landscapes. The rise of digital currencies and fintech innovations presents both challenges and opportunities for traditional banking practices.

8.1 Trends to Watch

- Digital Banking: The growth of online and mobile banking is reshaping how consumers interact with financial institutions.

- Regulatory Changes: As new technologies emerge, regulatory frameworks will need to adapt to ensure consumer protection and financial stability.

Conclusion

In conclusion, fractional banking is a fundamental aspect of the modern financial system, enabling banks to create money and facilitate economic growth. While it offers numerous benefits, it also poses risks that must be managed through effective regulation and oversight. Understanding fractional banking is essential for consumers, businesses, and policymakers alike.

We encourage you to share your thoughts on fractional banking in the comments below, and don't hesitate to explore more articles on our site for further insights into the world of finance.

Penutup

Thank you for taking the time to read this comprehensive guide on fractional banking. We hope you found it informative and engaging. Stay tuned for more articles that delve into various financial topics, helping you deepen your understanding of the ever-evolving financial landscape.

Unlocking The Secrets Of Crazy Sex Positions: A Comprehensive Guide

Understanding Butt Shapes: A Comprehensive Guide To Body Types And Fitness

What Kind Of Dog Is Bluey? A Comprehensive Guide

:max_bytes(150000):strip_icc()/fractionalreservebanking.asp-final-a5faeb741c464711ba434ee652c40ebf.png)