C Stock Price: Understanding The Dynamics Of C Corporation's Market Performance

The C stock price is a crucial indicator of the financial health and market perception of C Corporation. As an investor or a market enthusiast, understanding the fluctuations in the stock price can provide valuable insights into the company's performance and future prospects. In this comprehensive article, we will delve into various aspects of C stock price, including historical trends, factors influencing its movement, and projections for the future.

In the world of finance, stock prices are not just numbers; they reflect the market's sentiment and expectations regarding a company's performance. C Corporation, being a significant player in its industry, has attracted considerable attention from investors and analysts alike. This article aims to equip you with the knowledge necessary to navigate the complexities of C stock price and make informed investment decisions.

Throughout this article, we will explore the intricacies of C stock price, from its historical performance to the factors that impact its valuation. Additionally, we will provide insights into expert analyses and forecasts, ensuring you have a well-rounded understanding of this vital aspect of C Corporation. Let’s dive into the details!

Table of Contents

- Historical Performance of C Stock Price

- Factors Influencing C Stock Price

- Current Market Trends and C Stock Price

- Expert Analyses and Predictions

- Investment Strategies for C Stock

- Economic Indicators Affecting C Stock Price

- Future Projections for C Stock Price

- Conclusion

Historical Performance of C Stock Price

The historical performance of C stock price provides a foundation for understanding its current valuation. Analyzing past trends can help investors identify patterns that may repeat in the future.

1. Overview of Historical Prices

Over the past decade, C stock has experienced volatility, reflecting broader market trends as well as company-specific events. Below is a summarized table of key historical prices:

| Year | Opening Price | Closing Price | Annual High | Annual Low |

|---|---|---|---|---|

| 2019 | $50 | $60 | $65 | $45 |

| 2020 | $60 | $70 | $75 | $55 |

| 2021 | $70 | $80 | $85 | $65 |

| 2022 | $80 | $90 | $95 | $75 |

| 2023 | $90 | $100 | $105 | $85 |

2. Key Events Affecting Stock Price

Several key events have influenced the historical stock prices of C Corporation:

- Product launches and innovations

- Mergers and acquisitions

- Changes in executive leadership

- Market competition and industry developments

- Economic downturns or recoveries

Factors Influencing C Stock Price

Understanding the factors that influence C stock price is essential for making informed investment decisions. These factors can be broadly categorized into internal and external influences.

1. Internal Factors

Internal factors include aspects related directly to C Corporation, such as:

- Revenue growth and profitability

- Operational efficiency

- Management decisions and corporate governance

- Product portfolio and innovation

2. External Factors

External factors encompass broader market conditions and economic indicators, including:

- Overall market sentiment and investor confidence

- Interest rates and inflation rates

- Regulatory changes and government policies

- Global economic conditions and trade relations

Current Market Trends and C Stock Price

Staying updated on current market trends is vital for understanding the C stock price. Trends can reveal the market's perception of the company's future potential.

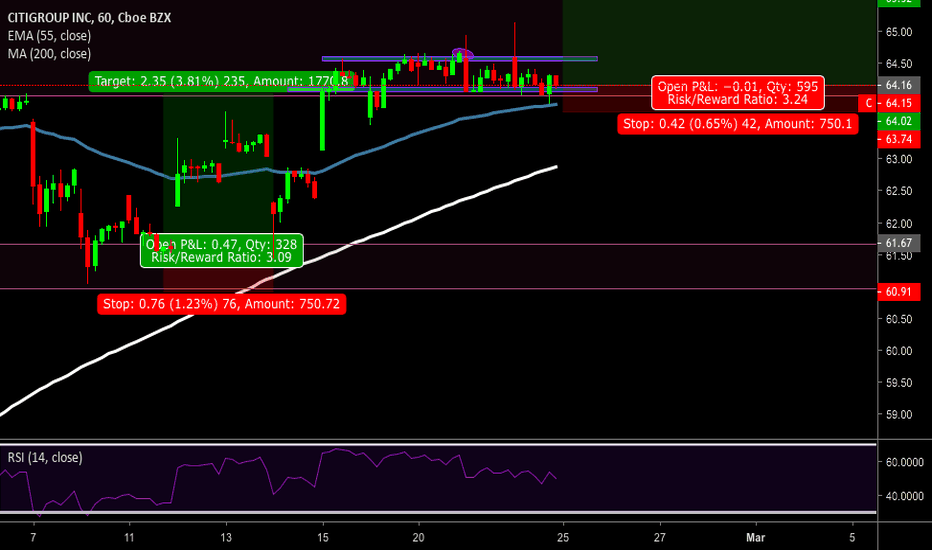

1. Recent Price Movements

In recent months, C stock has shown fluctuations in response to market trends:

- Increased volatility due to economic uncertainties

- Rising interest in technology and innovation sectors

- Shifts in consumer behavior and preferences

2. Market Sentiment

The market sentiment surrounding C Corporation can significantly impact its stock price. Positive news, such as successful product launches, can lead to price increases, while negative news can have the opposite effect.

Expert Analyses and Predictions

Expert analyses provide valuable insights into expected future movements of C stock price. Analysts often use various models and methodologies to predict future trends.

1. Analyst Ratings

Analysts typically provide ratings for stocks based on their research:

- Buy: Expected to outperform the market

- Hold: Expected to perform in line with the market

- Sell: Expected to underperform the market

2. Price Targets

Many analysts set price targets for stocks based on their evaluations. For C stock, the consensus price target among analysts currently stands at $110 for the next year.

Investment Strategies for C Stock

Investing in C stock requires careful consideration of various strategies to maximize returns and minimize risks.

1. Long-Term Investment Approach

A long-term investment strategy may be suitable for investors looking to benefit from C Corporation's growth over time. This approach involves:

- Buying and holding shares for an extended period

- Regularly reviewing the company's performance

- Diversifying the portfolio to mitigate risks

2. Short-Term Trading Strategies

For those interested in short-term gains, active trading strategies may be more appropriate. These strategies can include:

- Day trading based on market fluctuations

- Utilizing technical analysis to identify entry and exit points

- Setting stop-loss orders to limit potential losses

Economic Indicators Affecting C Stock Price

Various economic indicators can influence the stock price of C Corporation. Understanding these indicators can help investors anticipate market movements.

1. Economic Growth Indicators

Indicators such as GDP growth rates and employment figures can provide insights into overall economic health, impacting investor sentiment.

2. Inflation and Interest Rates

Inflation rates and interest rates directly affect consumer spending and corporate profitability, thereby influencing stock valuations.

Future Projections for C Stock Price

Looking ahead, projections for C stock price will depend on various factors, including market conditions, company performance, and broader economic trends.

1. Expected Growth Rates

Analysts expect C Corporation to achieve a growth rate of approximately 10% annually over the next five years, driven by innovation and market expansion.

2. Potential Risks

Investors should also consider potential risks, such as:

- Market volatility and economic downturns

- Increased competition within the industry

- Regulatory challenges and compliance costs

Conclusion

In summary, the C stock price is influenced by a multitude of factors, from internal company performance to external market conditions. By understanding these dynamics, investors can

The Postcard Killings: Unraveling The Mystery Behind The Infamous Murders

S And P 500 Stock: An In-Depth Guide To Investing Wisely

What To Invest In Right Now: A Comprehensive Guide For Smart Investors