Understanding USDRUB: The Dynamics Of The US Dollar To Russian Ruble Exchange Rate

The USDRUB exchange rate is a significant financial metric that reflects the economic relationship between the United States and Russia. In the world of foreign exchange, understanding various currency pairs is crucial for investors, traders, and economists alike. The US dollar (USD) serves as a global reserve currency, while the Russian ruble (RUB) plays a vital role in Russia's economy. This article delves into the intricacies of the USDRUB exchange rate, exploring its historical context, factors influencing its fluctuations, and its implications for various stakeholders.

In recent years, the USDRUB exchange rate has experienced significant volatility, driven by a multitude of factors including geopolitical tensions, oil prices, and economic sanctions. Understanding these dynamics is not only important for financial professionals but also for anyone interested in global economics. By examining the underlying factors that affect the USDRUB rate, we can gain insights into broader economic trends and the potential future movements of this currency pair.

This comprehensive guide will explore the history of the US dollar and Russian ruble, the factors that influence the exchange rate, trading strategies, and predictions for the future. Whether you are a trader looking to capitalize on fluctuations or an individual seeking to better understand international finance, this article will equip you with the knowledge you need about USDRUB.

Table of Contents

- 1. History of USDRUB Exchange Rate

- 2. Factors Influencing the USDRUB Exchange Rate

- 3. Trading Strategies Involving USDRUB

- 4. Economic Impact of USDRUB Fluctuations

- 5. Predictions for the Future of USDRUB

- 6. Key Data and Statistics

- 7. Conclusion

- 8. References

1. History of USDRUB Exchange Rate

The history of the USDRUB exchange rate provides essential context for understanding its current dynamics. The ruble has undergone various phases of reform and devaluation since the fall of the Soviet Union in 1991. Initially, the ruble experienced hyperinflation, which drastically reduced its value against the dollar.

In the early 2000s, the USDRUB rate began to stabilize, largely due to rising oil prices and economic reforms in Russia. The exchange rate was relatively stable until geopolitical tensions and sanctions began to impact the Russian economy.

Key Historical Events

- 1991: Collapse of the Soviet Union and initial ruble devaluation.

- 1998: Russian financial crisis leads to significant ruble depreciation.

- 2008: Global financial crisis affects both currencies.

- 2014: Western sanctions imposed on Russia following the annexation of Crimea.

- 2020: COVID-19 pandemic causes turmoil in global markets.

2. Factors Influencing the USDRUB Exchange Rate

Several factors contribute to the fluctuations in the USDRUB exchange rate. Understanding these factors is crucial for predicting future movements and making informed trading decisions.

Geopolitical Tensions

Geopolitical events can significantly impact the USDRUB exchange rate. For instance, sanctions imposed by Western countries on Russia have historically led to a decline in the ruble's value. The political climate, including relations between the US and Russia, plays a crucial role in currency valuation.

Oil Prices

As a major oil exporter, Russia's economy is highly sensitive to changes in oil prices. A rise in oil prices generally leads to a stronger ruble, while a decline can result in depreciation. The correlation between oil prices and the ruble is a critical factor for traders to monitor.

Economic Indicators

Key economic indicators such as GDP growth, inflation rates, and employment figures can also influence the USDRUB exchange rate. Positive economic data from the US may strengthen the dollar, while strong economic performance in Russia can bolster the ruble.

3. Trading Strategies Involving USDRUB

Traders looking to capitalize on USDRUB fluctuations can employ various strategies. Understanding market trends and analysis methods can aid in making informed decisions.

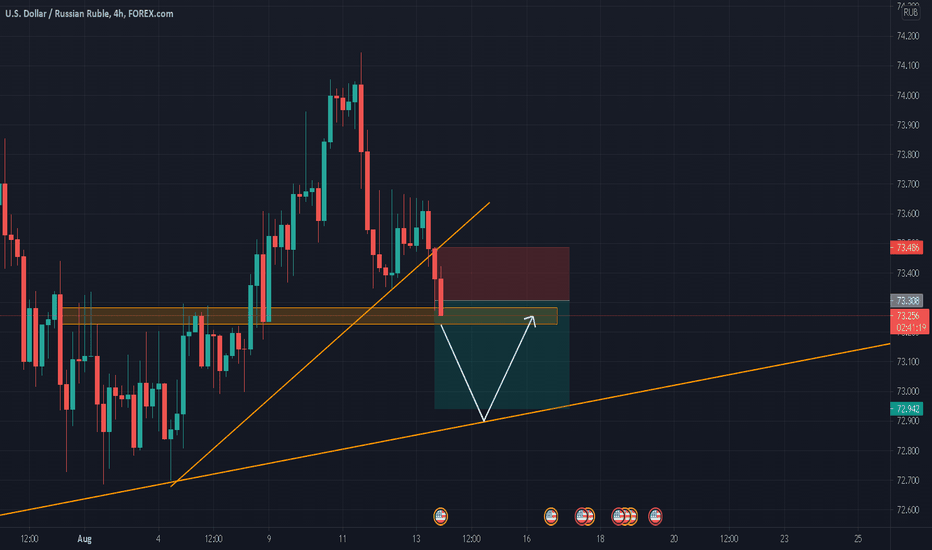

Technical Analysis

Technical analysis involves studying historical price movements to predict future trends. Traders often use charts and indicators to identify patterns in the USDRUB exchange rate.

Fundamental Analysis

Fundamental analysis focuses on economic indicators and geopolitical events. Traders may analyze reports on oil prices, economic growth, and inflation to assess potential movements in the USDRUB rate.

4. Economic Impact of USDRUB Fluctuations

The USDRUB exchange rate has significant implications for both economies. Fluctuations in the exchange rate can affect trade balances, inflation, and foreign investments.

Trade Balances

A weaker ruble can make Russian exports cheaper, potentially boosting trade. Conversely, a strong ruble may hurt Russian exporters but benefit consumers through lower import costs.

Inflation

Changes in the exchange rate can impact inflation rates in Russia. A depreciating ruble can lead to higher import prices, contributing to inflationary pressures.

5. Predictions for the Future of USDRUB

While predicting currency movements is inherently uncertain, analysts use various methods to forecast the future of the USDRUB exchange rate. Factors such as oil prices, geopolitical developments, and economic performance will continue to play crucial roles.

Market Sentiment

Market sentiment can also influence predictions. Traders often react to news and events, creating short-term volatility that can be challenging to predict.

6. Key Data and Statistics

| Year | Average USDRUB Rate | Notable Events |

|---|---|---|

| 2014 | 34.5 | Sanctions imposed on Russia |

| 2016 | 67.2 | Oil prices decline |

| 2020 | 69.9 | COVID-19 pandemic |

| 2023 | 78.5 | Ongoing geopolitical tensions |

7. Conclusion

In conclusion, the USDRUB exchange rate is influenced by a multitude of factors, including geopolitical tensions, oil prices, and economic indicators. Understanding these dynamics is essential for traders, investors, and anyone interested in global economics. As we move forward, monitoring these factors will be key to predicting the future of the USDRUB exchange rate.

We encourage readers to engage with this topic further—leave a comment, share your thoughts, or explore related articles on our site for a deeper understanding of currency markets.

8. References

- International Monetary Fund (IMF)

- World Bank Economic Indicators

- Trading Economics - Historical Data

- Reuters - Financial News

Tennessee Titans Football Score: Everything You Need To Know

Understanding Sedn: A Comprehensive Guide To Its Importance And Applications

Exploring The Life And Career Of Jacob De La Hoya