The Unveiling Of XBI: A Comprehensive Guide To Understanding And Utilizing It Effectively

The world of investments is constantly evolving, and one of the most intriguing aspects of this evolution is the rise of XBI. This investment vehicle has gained significant attention due to its potential for high returns and unique structure. In this article, we will dive deep into what XBI is, how it works, and its relevance in today's financial landscape. Understanding XBI is crucial for anyone interested in maximizing their investment strategies and achieving financial stability.

As we explore the intricacies of XBI, you will discover the various components that make it a valuable addition to your investment portfolio. From its inception to its current market position, we will analyze the factors that contribute to its growth and success. This comprehensive guide will not only provide expert insights but also equip you with the necessary knowledge to navigate the complexities of XBI confidently.

Whether you are a seasoned investor or just starting your financial journey, this detailed exploration of XBI will enhance your understanding and enable you to make informed decisions. So, let’s embark on this informative journey to uncover the fascinating world of XBI.

Table of Contents

- What is XBI?

- Biography of XBI

- How XBI Works

- Benefits of XBI

- Risks Involved in XBI

- Investing in XBI

- The Future of XBI

- Conclusion

What is XBI?

XBI, or Exchange Traded Fund, is a type of investment fund that trades on stock exchanges, much like stocks. It is designed to track the performance of a specific index, sector, or asset class. XBI primarily focuses on biotechnology companies and aims to provide investors with exposure to the biotech sector's growth potential.

As an investor, understanding XBI is vital, especially if you are interested in the healthcare and biotechnology industries. By investing in XBI, you gain diversified exposure to a range of biotechnology firms, reducing the risk associated with investing in individual stocks.

Biography of XBI

| Attribute | Details |

|---|---|

| Name | XBI |

| Type | Exchange-Traded Fund |

| Focus | Biotechnology Sector |

| Inception Date | January 2006 |

| Issuing Company | State Street Global Advisors |

| Expense Ratio | 0.35% |

History and Development of XBI

XBI was launched in January 2006 by State Street Global Advisors, aiming to provide investors with a tool to gain exposure to the biotechnology sector. Over the years, it has evolved to accommodate the changing dynamics of the biotech industry, adapting to new trends and innovations.

XBI’s Market Performance

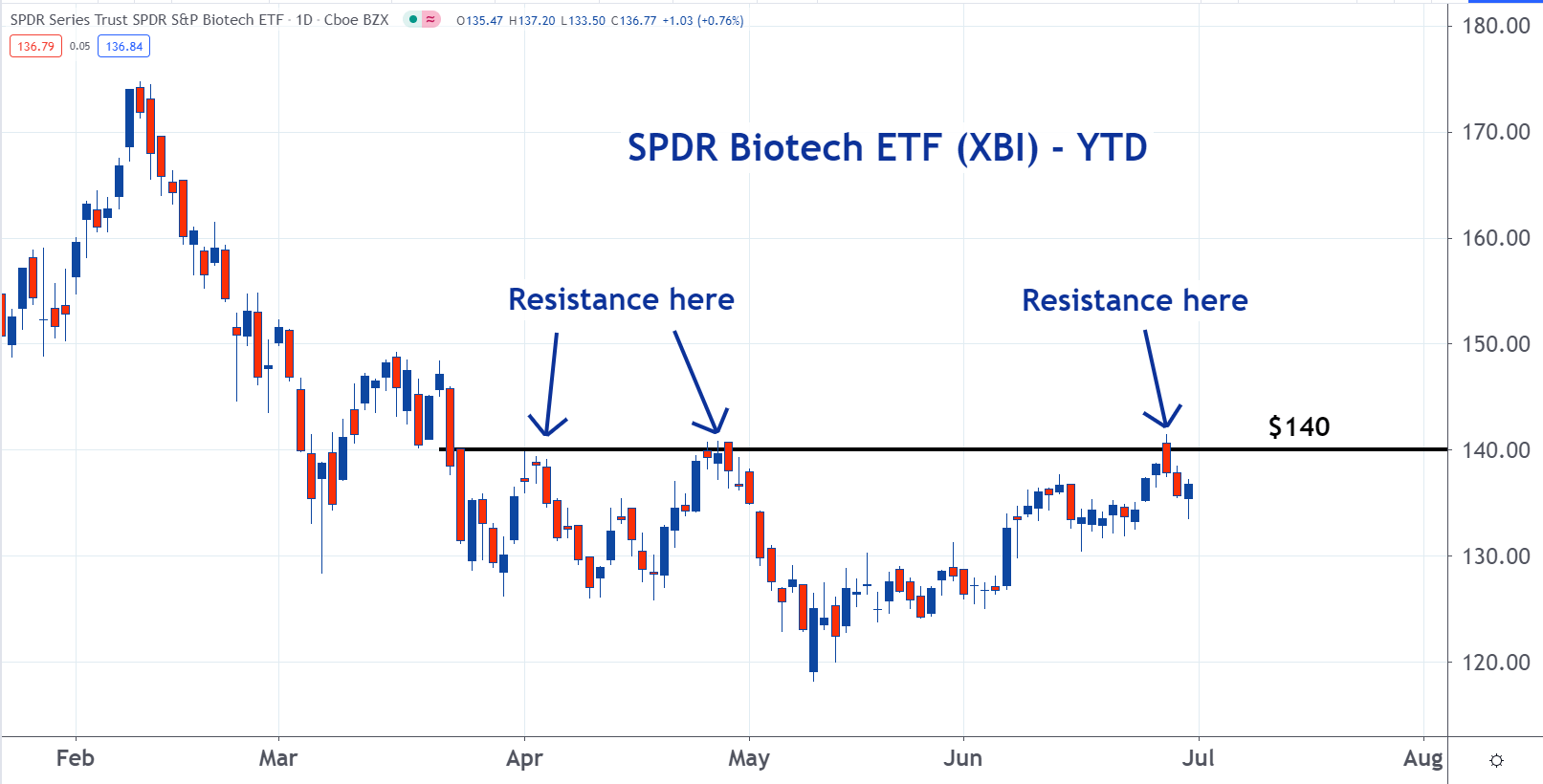

Since its inception, XBI has experienced significant fluctuations in performance, reflecting the volatility of the biotechnology sector. However, it has also shown impressive growth, particularly during periods of innovation and increased demand for healthcare solutions.

How XBI Works

XBI operates by pooling investors' funds to purchase shares of various biotechnology companies. It is structured to track an underlying index, specifically the S&P Biotechnology Select Industry Index. This index includes a diverse range of companies involved in the biotechnology sector, from large pharmaceutical firms to emerging biotech startups.

Investors can buy and sell shares of XBI throughout the trading day, just like individual stocks. This liquidity is one of the key advantages of investing in ETFs like XBI, as it allows for quick adjustments to investment strategies based on market conditions.

Benefits of XBI

Investing in XBI offers several advantages, including:

- Diversification: XBI provides exposure to a wide range of biotechnology companies, reducing the risk associated with investing in individual stocks.

- Liquidity: Shares of XBI can be traded throughout the day, offering flexibility for investors to make timely decisions.

- Cost-Effective: With a relatively low expense ratio, XBI is a cost-effective way to invest in the biotech sector.

- Access to Growth Potential: The biotechnology industry is known for its innovation and growth, making XBI an attractive option for investors seeking high returns.

Risks Involved in XBI

While XBI offers numerous benefits, it is essential to be aware of the risks associated with investing in this ETF:

- Volatility: The biotech sector is known for its price volatility, which can lead to significant fluctuations in XBI’s value.

- Market Risk: Like all investments, XBI is subject to market risk, meaning its performance can be affected by broader market trends.

- Sector-Specific Risks: Factors such as regulatory changes, competition, and technological advancements can impact the performance of the biotechnology sector.

Investing in XBI

To invest in XBI, follow these steps:

- Research: Conduct thorough research on XBI and the biotechnology sector to understand potential risks and rewards.

- Open a Brokerage Account: Choose a reputable brokerage platform that offers access to ETFs.

- Fund Your Account: Deposit funds into your brokerage account to facilitate your investment.

- Place Your Order: Decide how many shares of XBI you want to purchase and place your order through your brokerage platform.

The Future of XBI

As the biotechnology sector continues to evolve, XBI is well-positioned to take advantage of new opportunities. With advancements in medical research, drug development, and healthcare technologies, the potential for growth in this sector remains robust. Investors who stay informed about industry trends and developments will be better equipped to navigate the future of XBI.

Conclusion

In conclusion, XBI represents a unique investment opportunity for those looking to gain exposure to the biotechnology sector. With its diversified approach, liquidity, and potential for high returns, XBI can be a valuable addition to any investment portfolio. However, it is essential to be aware of the associated risks and conduct thorough research before making investment decisions.

We encourage you to share your thoughts in the comments below, explore other articles on our site, and stay updated on the latest trends in the financial market. Your financial journey is important, and we are here to support you every step of the way.

Thank you for reading, and we hope to see you again soon!

How Much Does Sasha Banks Have? A Comprehensive Look At Her Wealth And Success

Understanding CRM Ticker: Revolutionizing Customer Relationship Management

The Oncology Institute Of Hope And Innovation: Pioneering Cancer Care