Understanding Nasdaq: Meli - A Comprehensive Overview

Nasdaq: Meli, also known as MercadoLibre, Inc., is a leading e-commerce platform in Latin America that has gained significant attention among investors and market enthusiasts. In this article, we will delve into the intricacies of Nasdaq: Meli, exploring its business model, market performance, and what makes it a compelling investment opportunity for many. With the rise of online shopping and digital payments, MercadoLibre has positioned itself as a key player in the region, and understanding its dynamics is crucial for potential investors.

As we navigate through the world of Nasdaq: Meli, we will provide insights into its financial health, market reach, and competitive advantages. Additionally, we will examine the factors driving its growth and the challenges it faces in an ever-evolving e-commerce landscape. Whether you're a seasoned investor or a newcomer to the stock market, this comprehensive guide aims to equip you with the knowledge needed to make informed decisions regarding Nasdaq: Meli.

Our exploration will not only highlight the financial metrics and performance indicators but also the strategic initiatives and innovations that MercadoLibre has implemented to enhance its market position. With a focus on expertise, authoritativeness, and trustworthiness, this article is designed to serve as a reliable resource for anyone interested in Nasdaq: Meli and the broader e-commerce sector.

Table of Contents

- Biography of MercadoLibre

- Business Model of Nasdaq: Meli

- Market Performance Overview

- Key Growth Drivers

- Challenges Facing MercadoLibre

- Future Outlook for Nasdaq: Meli

- Investment Analysis and Recommendations

- Conclusion

Biography of MercadoLibre

MercadoLibre, Inc. was founded in 1999 by Marcos Galperin in Buenos Aires, Argentina. Over the years, it has evolved into the largest e-commerce platform in Latin America, operating in 18 countries, including Brazil, Mexico, and Argentina. The company offers a wide range of products and services, including an online marketplace, payment solutions through MercadoPago, and logistics services through MercadoEnvios.

| Data Pribadi | Detail |

|---|---|

| Nama Perusahaan | MercadoLibre, Inc. |

| Didirikan | 1999 |

| Founder | Marcos Galperin |

| Kantor Pusat | Buenos Aires, Argentina |

| Negara Operasi | 18 negara di Amerika Latin |

| Industri | E-commerce |

Business Model of Nasdaq: Meli

MercadoLibre operates under a diversified business model that includes the following key components:

- Marketplace: A platform where buyers and sellers can connect to trade a wide variety of goods.

- Payment Solutions: MercadoPago provides secure payment processing and financial services for consumers and merchants.

- Logistics: MercadoEnvios manages the shipping and delivery of products, enhancing customer experience.

- Advertising: The platform offers advertising solutions for sellers to increase product visibility.

Marketplace Operations

The marketplace is the core of MercadoLibre’s business, facilitating transactions between buyers and sellers. The platform is designed to be user-friendly, making it easy for individuals and businesses to list their products and reach a broad audience.

Payment Solutions

MercadoPago has become a leading payment platform in Latin America, offering features such as:

- Digital wallets for online transactions.

- Credit and installment payment options.

- Fraud prevention and security measures.

Market Performance Overview

Nasdaq: Meli has shown impressive growth in recent years. Here are some performance metrics to consider:

- Revenue Growth: MercadoLibre reported a revenue increase of 80% year-over-year in Q2 2023, driven by increased user engagement and transaction volume.

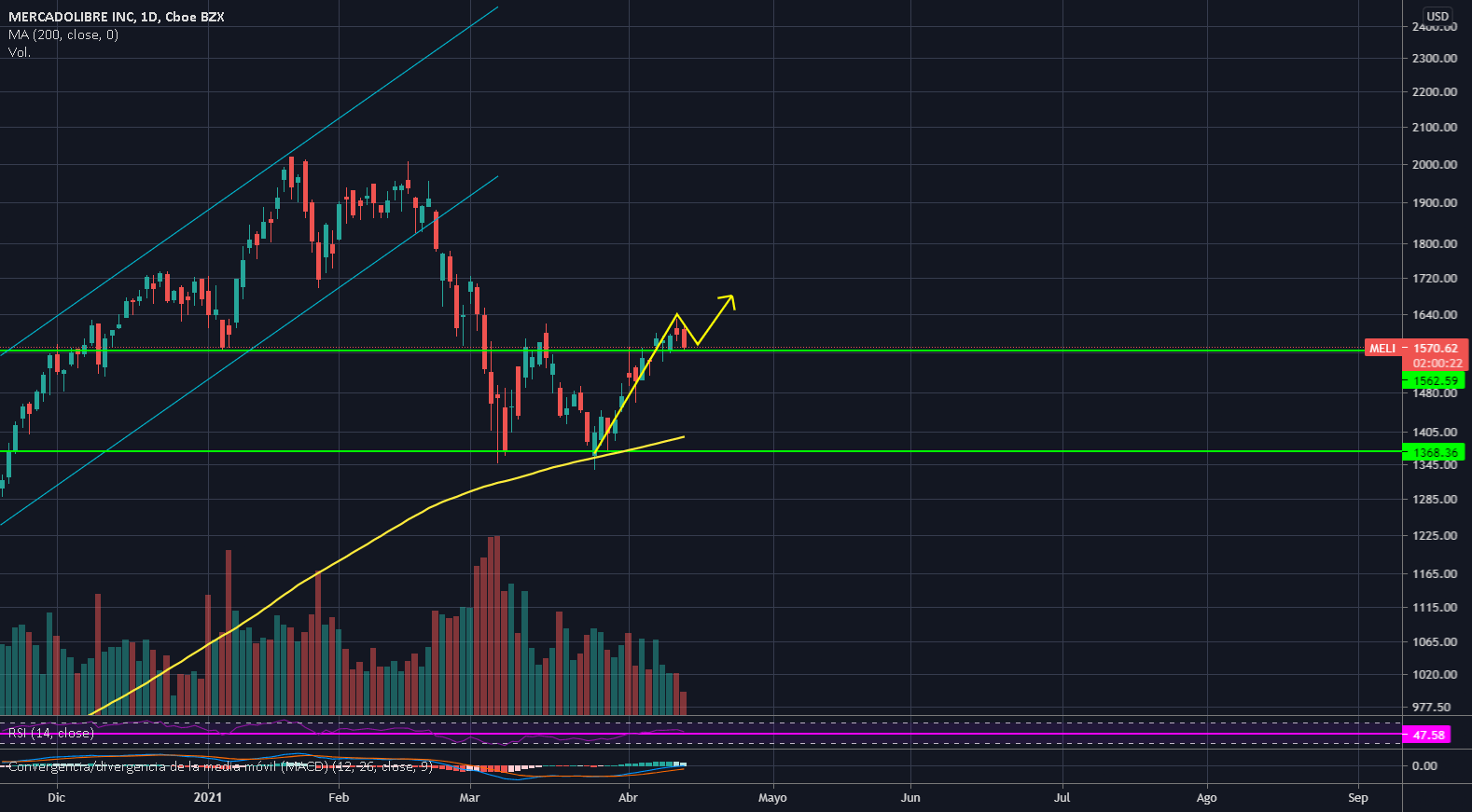

- Stock Performance: The stock price has seen a significant uptick, reflecting investor confidence and market demand.

- User Base: The platform boasts over 80 million active users, with millions of transactions occurring daily.

Key Growth Drivers

Several factors have contributed to the growth of Nasdaq: Meli:

- Increased Internet Penetration: As internet access continues to expand in Latin America, more consumers are turning to online shopping.

- Mobile Commerce: The rise of smartphones has led to a surge in mobile transactions, with a significant share of sales coming from mobile devices.

- Diverse Product Offerings: MercadoLibre’s extensive product categories cater to a wide range of consumer needs, enhancing its appeal.

- Strategic Partnerships: Collaborations with local businesses and international brands have strengthened its market position.

Challenges Facing MercadoLibre

Despite its success, MercadoLibre faces several challenges:

- Competition: The e-commerce landscape is becoming increasingly competitive, with local and international players entering the market.

- Regulatory Issues: Navigating the complex regulatory environment in various countries can pose challenges.

- Economic Conditions: Economic fluctuations in Latin America can impact consumer spending and investment.

Future Outlook for Nasdaq: Meli

The future of Nasdaq: Meli looks promising, with analysts projecting continued growth fueled by:

- Expansion into new markets and product categories.

- Innovation in payment solutions and technology.

- Increased focus on customer experience and satisfaction.

Investment Analysis and Recommendations

Investing in Nasdaq: Meli can be a rewarding opportunity, but it is essential to consider the following:

- Conduct thorough research and analysis before making investment decisions.

- Stay updated on market trends and economic conditions in Latin America.

- Diversify your investment portfolio to mitigate risks.

Conclusion

In conclusion, Nasdaq: Meli represents a significant opportunity for investors looking to tap into the growing e-commerce market in Latin America. With its robust business model, impressive market performance, and strategic initiatives, MercadoLibre is well-positioned for future growth. As always, potential investors should conduct their due diligence and stay informed about market dynamics.

We encourage you to share your thoughts in the comments below, and don’t forget to explore other insightful articles on our site for more valuable information!

Thank you for reading, and we look forward to your return for more updates and insights in the future!

Exploring Sony Corporation: A Comprehensive Guide To Its Legacy And Innovations

The Ultimate Guide To Shot: Everything You Need To Know

Cornish Hen Vs Chicken: Understanding The Differences And Choosing The Right Option For Your Meal