Understanding GUSH Stock Price: A Comprehensive Guide

GUSH stock price has become a crucial topic for many investors looking to navigate the volatile landscape of the stock market. With the rise of exchange-traded funds (ETFs) and the increasing interest in various sectors, GUSH has garnered attention for its unique approach to investing in the energy market. This article will delve into the intricacies of GUSH stock price, exploring its performance, market factors, and what investors need to know before diving in.

The energy sector is known for its fluctuations, influenced by numerous factors such as geopolitical events, supply and demand dynamics, and technological advancements. Understanding the GUSH stock price not only requires a grasp of these elements but also an insight into the broader market trends and investor sentiment. In this article, we will take an in-depth look at GUSH, its historical performance, and the strategies that can be employed for successful investing.

Whether you are a seasoned investor or new to the stock market, this comprehensive guide will provide valuable insights into GUSH stock price. We aim to equip you with the knowledge necessary to make informed investment decisions while highlighting the importance of research and due diligence in the investment process.

Table of Contents

- 1. What is GUSH?

- 2. Historical Performance of GUSH Stock Price

- 3. Factors Affecting GUSH Stock Price

- 4. Investment Strategies for GUSH

- 5. Risks Involved with GUSH

- 6. Future Outlook for GUSH Stock Price

- 7. How to Buy GUSH Stock

- 8. Conclusion

1. What is GUSH?

GUSH is an exchange-traded fund (ETF) that seeks to provide investors with exposure to the energy sector, particularly focusing on companies involved in the exploration and production of oil and gas. The fund aims to achieve a return that is 2x the daily performance of the S&P Oil & Gas Exploration & Production Select Industry Index. This leveraged approach allows investors to amplify their potential gains, but it also comes with increased risks.

1.1 Key Features of GUSH

- Leverage: GUSH utilizes a 2x leveraged strategy, magnifying both potential gains and losses.

- Focus on Energy: The ETF is concentrated on companies involved in oil and gas exploration and production.

- Daily Rebalancing: GUSH is rebalanced daily to maintain its leverage ratio.

- Volatility: The fund is subject to higher volatility compared to traditional ETFs due to its leveraged nature.

2. Historical Performance of GUSH Stock Price

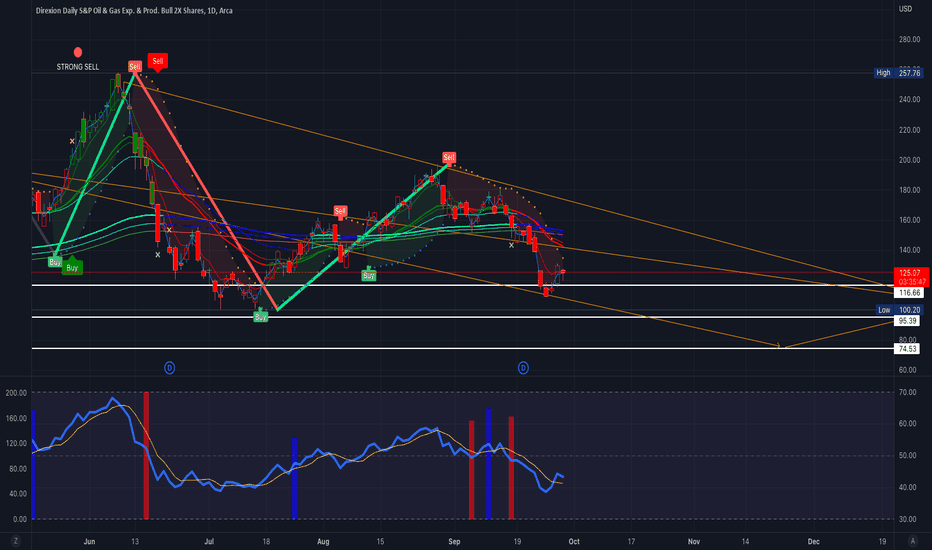

Analyzing the historical performance of GUSH stock price provides valuable insights into its behavior during various market conditions. Since its inception, GUSH has experienced significant price fluctuations, reflecting the inherent volatility of the energy sector.

2.1 Price Trends Over the Years

GUSH stock price has shown remarkable growth during periods of rising oil prices, often correlating with geopolitical events that impact oil supply. Conversely, during downturns in the energy market, GUSH has experienced sharp declines, illustrating the risks associated with leveraged ETFs.

2.2 Performance Comparison with Other ETFs

When comparing GUSH with other energy-focused ETFs, it is essential to consider the performance metrics such as total returns, volatility, and risk-adjusted returns. Investors should look for historical data to assess how GUSH has fared against its peers.

3. Factors Affecting GUSH Stock Price

Several factors influence the GUSH stock price, including macroeconomic indicators, geopolitical dynamics, and market sentiment. Understanding these factors is crucial for investors seeking to predict future movements in GUSH.

3.1 Geopolitical Events

Events such as conflicts in oil-producing regions, sanctions on oil exports, and OPEC's production decisions can significantly impact oil prices and, consequently, GUSH stock price.

3.2 Supply and Demand Dynamics

The balance between oil supply and demand is a fundamental driver of GUSH stock price. Factors such as increased production from U.S. shale oil and changes in global energy consumption patterns can create volatility in the market.

4. Investment Strategies for GUSH

Investing in GUSH requires a well-thought-out strategy due to its leveraged nature. Here are some strategies that investors can consider:

4.1 Short-Term Trading

Given its volatility, GUSH is suitable for short-term trading strategies. Traders can capitalize on price swings by entering and exiting positions quickly.

4.2 Hedging

Investors can use GUSH as a hedge against declines in the energy sector. By holding GUSH, investors may offset losses in their long positions in traditional energy stocks.

5. Risks Involved with GUSH

While GUSH offers the potential for high returns, it is essential to recognize the associated risks:

- Leverage Risk: The use of leverage can magnify losses, leading to significant drawdowns.

- Market Volatility: The energy market is inherently volatile, and GUSH stock price can fluctuate widely.

- Compounding Effects: Daily rebalancing can lead to compounding effects that may erode returns over time.

6. Future Outlook for GUSH Stock Price

The future outlook for GUSH stock price will depend on various factors, including global oil demand, technological advancements in energy production, and geopolitical stability. Analysts predict that as the world transitions to renewable energy, GUSH's performance may be impacted by shifts in investor sentiment.

7. How to Buy GUSH Stock

Investing in GUSH stock is relatively straightforward. Here’s a step-by-step guide:

- Choose a Brokerage: Select a brokerage that offers access to ETFs.

- Open an Account: Complete the necessary paperwork and fund your account.

- Search for GUSH: Use the ticker symbol "GUSH" to find the ETF.

- Place Your Order: Decide on the number of shares you want to purchase and execute your order.

8. Conclusion

In summary, understanding GUSH stock price is vital for investors looking to capitalize on the energy market. While it offers potential for high returns, it also comes with significant risks that must be carefully considered. We encourage you to conduct thorough research and consider your risk tolerance before investing in GUSH. If you found this article helpful, please leave a comment, share it with others, or explore our other articles for more insights.

Sources

- Investopedia - Understanding ETFs

- Yahoo Finance - GUSH Stock Analysis

- Bloomberg - Oil Market Analysis

Thank you for reading, and we hope to see you back for more informative content!

Aranmanai 4 OTT Release Date: Everything You Need To Know

The Cast Of Criminal Minds: A Deep Dive Into The Characters And Their Impact

Basketball Games From Yesterday: A Comprehensive Recap